“How a Fortune 500 manufacturer expanded their global direct sales channels with an optimized payment and credit strategy.”

Overview

Our client, a Fortune 500 manufacturer of electronic components, built a strategy to sell directly to more end customers (contract manufacturers) instead of through their traditional distribution channels.

Primary Drivers:

- Increase profit margin

- Create more visibility and predictability into their supply chain through smaller, more frequent orders

- Reduce potential product misuse by gaining more control over where products are sold

Challenges

How could they manage credit and payments to over 200,000 global, multi-currency buyers without adding any back office processes? For their customers, ordering on net terms was the “norm.” To convert buyers to direct online orders, they need to offer an intelligent, automated invoicing and credit program to optimize growth without adding back office process or risk.

Who were the primary client team members?

Treasury & Global Head of Accounts Receivable

Cash flow was not the issue (the company generates billions in annual profit). Rather, Treasury & A/R did not want to manage thousands of smaller, more frequent invoices and payments in house. The return on investment isn’t there and they’d prefer to have the predictability of being paid nightly for any new invoice generated.

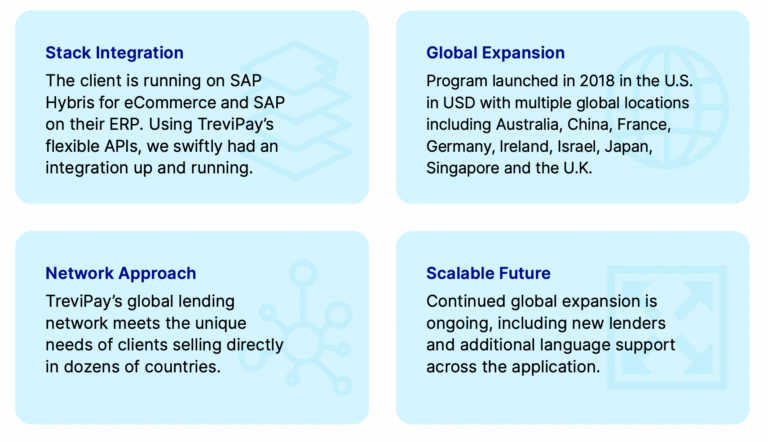

Director of eCommerce & Head of Payments

Their concern was all about scaling and speed without adding back office processes to slow them down. Expanding to other countries, adding currencies, maintaining global invoicing standards — these were things they asked TreviPay to manage so they could focus on adding new customers and growing revenue.

The Approach

The Results

3.3x

Increased order frequency for buyers with a corporate account versus credit card users

800%

Average year-over-year growth of invoice volume processed by client

2003%

Growth in available credit line to buyers over the last two years

40 Countries

Number of countries TreviPay manages credit, payments and accounts receivable for the client, includes the European Union, UK, USA, Canada, China, Japan and Taiwan.

5.6x

Average factor of increased order sizes for orders invoiced through TreviPay vs. credit card

$400 Million

Current annual invoice volume processed for all buyers

$1 Billion +

current monthly credit line in circulation for all buyers

25-30%

Profit margins for clients using TreviPay program