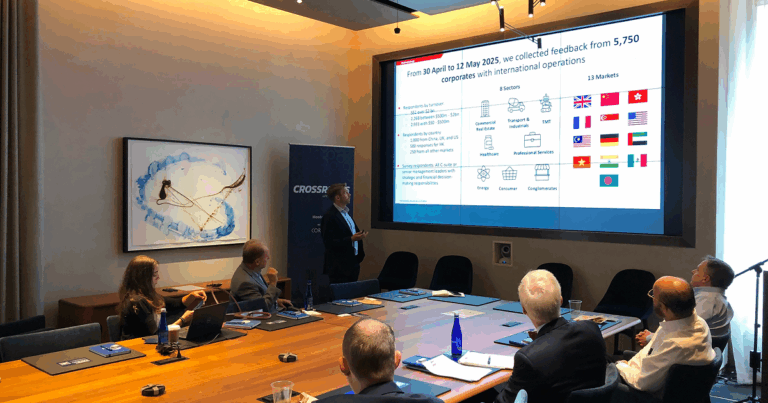

Hosted by Corsair on September 16, a curated group of merchant payments experts, fintech innovators and industry insiders gathered for a spirited exchange of ideas on the future of B2B payments as part of the Crossroads Fintech Salon Series. TreviPay’s Martha Salinas reflects on this meaningful dialogue with fellow leaders in payments, eCommerce and banking.

The best part of the Fintech Salons we have hosted this year in London, Sydney and New York City is bringing together different voices from across the payments ecosystem in a format that fosters a candid and energizing discussion. That was very much the case in our latest North American tour stop.

The discussion focused on practical steps global brands in retail, travel and manufacturing can take to make B2B payments an engine of growth. Four themes emerged from the half-day event: reducing friction where it impacts cash flow, designing for both efficiency and customer experience, grounding innovation in B2B buyer needs and the importance of ecosystem and process integrations.

Reducing Friction in Order-to-Cash

Several sessions highlighted how seemingly minor frictions in the order-to-cash process can cascade into real cash flow challenges. Buyers increasingly expect seamless ERP integration and consistent invoicing experiences — requirements that directly shape supplier choice and build trust. As I emphasised in our day’s opening remarks, 90% of global B2B buyers TreviPay surveyed cite trust as the primary consideration when choosing a supplier.

Attendees also agreed business buyers want the same level of tailored, seamless experiences they encounter in their day-to-day lives. One leader spoke to how these expectations are reshaping their B2B payment strategies, noting, “The corporate travel industry has changed quite a bit over the past decade… now it is all about personalization.” For finance leaders, that means payments must balance operational efficiency with flexible, customer-centric design (such as including Level III data for easy invoicing) to drive sales and strengthen corporate relationships. This representative emphasised the importance of a managed services program that meets buyer preferences while also delivering a lower cost of sale.

Later, a speaker and TreviPay client from a leading DTC manufacturer, illustrated the impact when these order-to-cash process frictions are removed: “Since we started with TreviPay, we’ve grown our B2B revenue 300%.” TreviPay’s managed program helps give their customers easier settlement options, like net terms and automated invoicing.

A speaker from one of the global payments providers validated the dual importance of fast, secure and reliable payment solutions alongside enhanced cash flow for corporates, explaining, “We take payables, receivables and treasury processes, and overlay them across three big best practices: operational efficiencies, cash flow optimization and value-added services. Those have become much more prevalent in conversations in recent years.” This has helped resolve past challenges including slow processing times, manual reconciliation, increased fraud attacks and a common difficulty in properly predicting future cash flows.

Efficiency and Experience Are Converging

Attendees agreed efficiency and customer experience can no longer be viewed as separate priorities. A seamless B2B checkout not only saves time for finance teams but also strengthens trust with buyers. As one moderator asked: “Can you deliver a better experience while driving efficiency?” The answer across industry representatives was a resounding yes.

Yet this is not easy. “It is so complicated in B2B payments to make that happen and make it happen seamlessly,” one participant from a global management consulting firm explained. Achieving this convergence requires connected, automated systems across invoicing, credit decisioning and payments, rather than stand-alone tools.

Listening to the B2B Buyer

A recurring point from the afternoon highlighted finance transformation is only successful if it mirrors what customers want. As a global customer experience leader reflected, “So many transformation efforts and technology optimizations do not get maximized in part because they didn’t put the people they serve at the absolute center and build around them.”

Buyers expect flexible terms, transparent billing and predictable settlement. Meeting those expectations requires finance leaders to listen deeply to their customers and design order-to-cash processes around them. Check out our vision for Zero Touch A/R which was designed with this exact theory in mind.

Several speakers noted when buyers feel understood and supported, loyalty and share of wallet increase. For finance leaders, this means customer-centric design is not just good service — it’s a measurable financial advantage. A leading fintech innovator underscored this shift: listening to the buyer voice is now as important as internal cost control in shaping payments strategy.

Innovation With Purpose

Innovation was discussed as targeted problem-solving, rather than an abstract race toward AI as we often see flood headlines. Attendees pointed to practical B2B use cases: faster onboarding, real-time credit decisioning, automated reconciliation and predictive cash flow forecasting.

I also reminded the room, “the surprising thing… is that as much as people talk about AI, they’re not talking enough about the data that has to be in the AI.” Clean data, reliable integrations and focused pilots with a human touch were seen as more valuable than chasing broad AI ambitions.

As attendees reflected on 2025 and opportunities for innovation, a keynote speaker from a research and advisory firm shared a few predictions around the B2B payments industry:

- Cash use worldwide will fall, displaced by the successful globalization of UPI and PIX

- Geopolitical tensions and wars will increase the flow of payments through alternative rails

- Rate cuts and funding will attract M&A activity

- One-click checkouts will backfire for some merchants, increasing their costs

Ultimately, modernization matters to stay ahead of these market predictions and global brands can’t afford to delay upgrading order-to-cash. A global management consultant reminded attendees of the scale of the opportunity in the global wholesale payments market, noting, “We’re talking about two and a half trillion dollars of revenue around the world… and yet much of this economy still runs on paper…While checks are illegal in some countries, we haven’t had the digitization wave in the same way as other markets.”

Integrations as the Connector Between Order-to-Cash Processes

From onboarding to settlement and funding, a fourth theme threaded through the Salon was the critical role of integrations. Finance leaders acknowledged efficiency gains and customer experience improvements collapse if handoffs between systems, teams and partners break down within the order-to-cash process.

One participant contextualized this with, “Should there ever be a killer app that does everything? In reality, probably no. But how do you get there? Integrations. If you have a firm that’s willing to do the legwork… it’s going to be a better trajectory overall for both buyer, supplier and the provider in the middle.”

This reinforced the idea that seamless order-to-cash requires not just automation but smooth transitions between humans and machines, between partners and networks, and ultimately between sellers and their buyers. Strong integrations reduce adoption barriers, speed to implementation and ensure finance leaders can protect cash flow while delivering consistent customer experiences.

The Role of Partnerships

Another theme, which ties into insights from the Crossroads London Salon, was the importance of selecting partners who can shoulder complexity and help scale financial operations globally. As one thought leader noted, “Sometimes innovation in B2B payments does not necessarily need to be in launching a new thing… it’s about making the connective tissue work much more seamlessly, and companies that are finding ways to make those connections and make it all work better for their clients will succeed.” It doesn’t have to be “flashy” so long as it’s a process or offering to enable growth and additional sales.

That perspective reframes the role of partnerships: to build interconnected ecosystems and expertise that no single finance team can realistically maintain on its own. Effective collaboration — whether with banks, technology providers or data partners — reduces operational strain while ensuring customers experience payments as smooth, trustworthy and aligned with their needs.

Key Actions for Finance Leaders Heading Into 2026

The Crossroads NYC Salon framed B2B payments as a lever for growth. By reducing friction, converging efficiency with customer experience, designing strategies around buyer needs and building strategic ecosystem integrations, finance leaders can unlock both operational savings and stronger relationships.

The discussions point toward a clear set of next steps for B2B finance leaders:

- Reassess the order-to-cash process with a buyer-first lens. Eliminate exception-prone steps that create friction for customers.

- Quantify the real cost of payment methods to balance automation and manual tasks while exploring alternatives that lower both cost and buyer effort.

- Focus innovation efforts where the data is clean and the outcome measurable, such as reconciliation, credit checks and forecasting.

- Build relationships with partners and fintechs who can take on risk and operational load, freeing team talent to add strategic value.

We left feeling inspired from the industry momentum in B2B payments, readying ourselves to listen deeply (to buyers), act fearlessly (to smooth change management) and collaborate relentlessly (to deliver meaningful programs).

Crossroads is Back for More in 2026!

The uniquely B2B conference will be back in the fall of 2026 with even more keynotes, breakouts and networking opportunities. Register today to join us in Kansas City November 8-10, 2026 for even more of what you love about the Crossroads experience.