Omnichannel Approach Guides Large European Electronics Retailer’s Digital Transformation Efforts

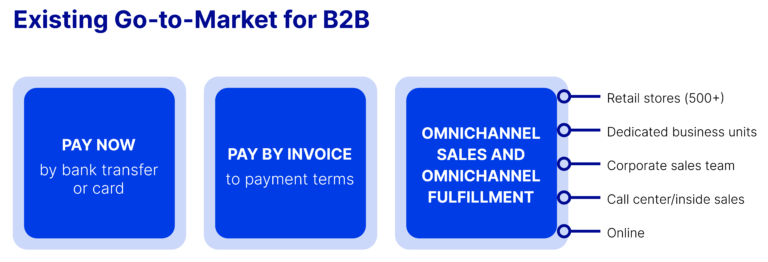

This iconic, large omnichannel electronics retailer with sales of over $12 Billion serves multiple markets across Europe. It sells to both B2C and B2B, including corporate, resellers, insurers, government-funded bodies and SMBs.

Learn how this European electronic retailer overcame the challenges of navigating a highly competitive landscape, external market forces and growing a B2B channel with the help of TreviPay’s 40-plus years of experience in B2B payments and state-of-the-art technology and financial services.