As the B2B payments landscape continues to evolve, enterprises are seeking more efficient ways to manage cash flow and streamline financial operations. This comes as recent projections from Mastercard highlight commercial payments as an $80 trillion opportunity with commercial debit and credit volumes at 13% of total Gross Dollar Value in 2024, 11% higher than the year prior.

Unfortunately, many businesses still rely on outdated processes, like paper checks, which can lead to higher risk of errors and lack real-time reconciliation. Merchants must navigate necessary back-office changes to meet the increased B2B payments volume and are turning to solutions that deliver both tech innovation and working capital optimization.

Two trends reshaping how businesses handle transactions are the rise of embedded payments and accounts receivable (A/R) automation. Recent market analysis from IDC highlights the growing importance of these capabilities, particularly as businesses demand frictionless checkouts.

Future-Proof Your B2B Payments Strategy

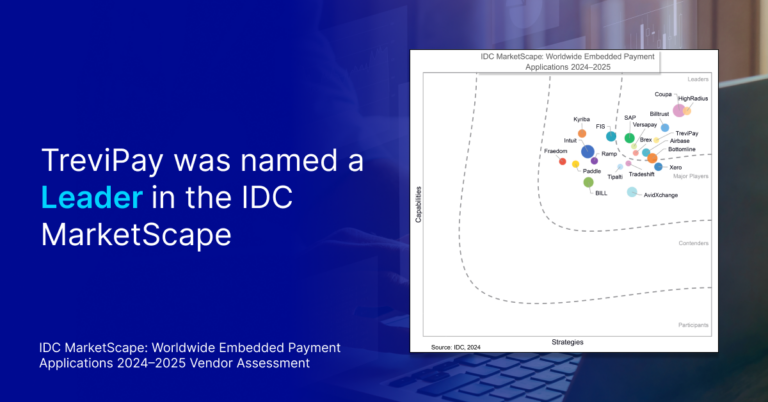

TreviPay has been recognized in two IDC MarketScape reports, being named a Leader in the IDC MarketScape: Worldwide Embedded Payment Applications 2024-2025 Vendor Assessment (doc #US51793524, December 2024) and a Major Player in the IDC MarketScape: Worldwide Accounts Receivable Automation Applications for the Enterprise 2024 Vendor Assessment (doc #US51740924, December 2024).

We believe the recognition in embedded payments validates TreviPay’s strategic focus on deep payment management functionality to deliver seamless payments experiences and flexible payment options for guaranteed Days Sales Outstanding (DSO). Robust API capabilities also enable merchants to directly integrate invoicing into any eCommerce platform, POS environment or order management platform. This is critical for building loyalty as 80% of B2B buyers say it’s very or extremely important that merchants conveniently integrate with their ERP platforms.

Also noteworthy in embedded payments capabilities is TreviPay’s Universal Acceptance offering with Mastercard. This solution makes it easier for suppliers to offer trade credit to business buyers, reducing upfront costs and credit approval barriers while accelerating suppliers’ speed to market.

Modernizing A/R Processes to Guarantee DSO

“Traditional accounts receivable processes are ripe for disruption. As we saw in our vendor assessment, this is a dynamic market with a range of A/R solutions for the enterprise, but only a few, like TreviPay, that offer an integrated order-to-cash solution along with native financing options,” said Kevin Permenter, senior research director, Financial Applications at IDC.

Leveraging technology to automate invoicing and payment tracking can improve efficiency, B2B buyer satisfaction and your Accounts Receivable Turnover Ratio. Comprehensive A/R management systems like TreviPay enhance efficiency and accuracy, so merchants can focus on more value-adding activities that require a human touch.

TreviPay’s API-first approach to A/R ensures that merchants can easily integrate TreviPay’s solutions into any existing technology stack. This flexibility, combined with co-branded solutions that can be embedded within the checkout process, enhances scalability and optimizes cash flow for businesses.

Maintaining Excellence

As a highly recognized industry player, TreviPay continues to invest in expanding its ecosystem and enhancing platform capabilities. The focus remains on serving global enterprise clients with solutions that automate core A/R processes, provide payment choice to buyers, and deliver guaranteed DSO to financial teams. This commitment is reflected in recent strategic partnerships, like with Allianz Trade, that strengthen TreviPay’s risk management capabilities and global reach.

AI will also continue to be a valuable tool that TreviPay uses in combination with human oversight to give our customers the power of automation bolstered by human knowledge.

The global B2B eCommerce market is expected to reach $36 billion USD by 2031 so choosing a vendor with the ability to combine advanced technology with flexible financing options becomes critical. We believe TreviPay’s dual recognition in these IDC MarketScape reports demonstrates the value of an integrated approach that addresses both the operational and financial needs of modern enterprises.

For more insights from the IDC MarketScape reports, download an excerpt of IDC MarketScape: Worldwide Accounts Receivable Automation Applications for the Enterprise 2024 Vendor Assessment and IDC MarketScape: Worldwide Embedded Payment Applications 2024–2025 Vendor Assessment today.

To learn more about how TreviPay can enhance your business’ financial performance, please visit our Solutions Page or Contact Us.