If cash flow is the lifeblood of most businesses, then invoice processing is its beating heart.

To extend this metaphor a little further: inefficiencies in invoice processing lead to general bad business health and a high risk of worse problems if not addressed.

An increasing number of businesses are learning that automating the invoice processing workflow is the cure they need.

Let’s take a closer look.

What is invoice processing?

Invoice processing is the administration of invoices. It includes each step from when they are received until when they are in the general ledger after payment.

It is usually conducted by the accounts payable department and aided by automated invoice processing software.

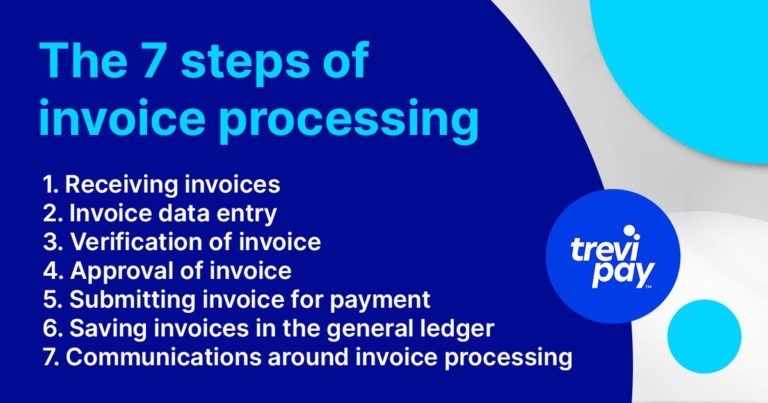

The 7 steps of invoice processing

The following are typical steps taken in invoice processing.

There may be slight variations to this process within each company or accounts payable team. Some companies might process invoices differently according to whether they are linked to a purchase order (PO) or not, for example.

1. Receiving invoices

For those directly involved in the process, ‘receiving invoices’ might seem like a misleadingly simple name for this task. ‘Receiving’ implies a passive and straightforward affair.

In reality, ‘hunting’ or ‘herding’ may be a better description.

Invoices can arrive in several forms (physical, digital, or even fax) via various means (multiple email addresses or senders). They might also arrive early, late, or not at all!

If the invoice hasn’t been received at the right time or channel, there is a chance that it might get lost in the system.

So, in summary, getting to the point where you have received an invoice isn’t always straightforward (see No. 7 below).

2. Invoice data entry

Once invoices are received, they need to be categorized and prioritized. This is done by checking the data of each one and entering it into other accounting systems.

Invoices come in many formats and may include mistakes. In the case of paper invoices, they often need to be scanned to create a digital form.

An important part of the data entry process is the assignment of general ledger codes (unique codes for each credit or debit entry) to each invoice. This helps make the following processing steps and reporting much easier.

This data entry process can be time-consuming and prone to errors, especially if done manually (see below, ‘Common Invoice Errors’).

3. Verification (Matching with supporting documents) of invoice

Blindly paying invoices without checking the details is eventually going to lead to mistakes.

Invoices need to be checked against supporting evidence, such as purchase orders (PO), credit notes, or other information that accounts for the costs listed on them.

Without an automated invoice processing system (see below, ‘Automated Invoice Processing’), supporting documents need to be gathered from various locations.

They might have been sent from and to different individuals, and the person collating them might be unaware of other existing communications or supporting documents that modify them.

They might also be fraudulent. Barclays has recently warned that invoice fraud (fraudsters posing as businesses that are updating their invoice payment details) is rising and could even make up to 55% of all money lost to scammers in the UK.

4. Approval of invoice

Once the above steps have taken place, someone needs to approve each invoice before payment is made.

Approval workflows vary but generally speaking, the requirements for approval are universal. Namely, whoever is approving an invoice needs:

- The invoice

- All supporting documents

- Any other information (notes, queries, deadline reminders, etc.)

5. Submitting invoice for payment

By the time the invoices are ready to be paid, the individual(s) in charge of invoice approval should be confident that there’s no human error or other outstanding issues.

Whether the invoices are marked for immediate, or later payment depends on each accounts payable team and each invoice.

If there are any extenuating circumstances, such as an overdue invoice, then it should be flagged by the sender at this stage.

6. Saving invoices in the general ledger

Invoices should be saved in the general ledger as soon as they are paid.

Missing, delaying, or making mistakes at this stage can obviously cause big problems with internal reporting and cash flow.

It can even damage external relationships. If an invoice isn’t recorded, incorrect overdue reminders could be sent to customers.

7. Communications around invoice processing

Each invoice processing step requires communication between your team and your customers. This could include:

- Confirmation of receipt

- Modifications

- Clarifications of errors (or potential errors)

- General questions

Other accounts payable functions may come into play, too, such as dunning, the use of credit note invoices, early payment discounts, invoice discounting, and invoice financing.

This usually takes place amidst a sea of other tasks occurring in the same location: the email inbox.

A study by Abode found the average US worker spends 3.1 hours checking work emails each day. This means that by the time it comes to check the invoice process, new information will have buried it further.

Common Invoice Errors

Whether it’s a few relatively large mistakes or the cumulative effect of many smaller ones, invoice errors can be costly.

In our experience, two of the most common are:

1. Sales tax exemption mistakes

Sales and use tax rules vary in each state. Certificates for tax exemptions are issued by the purchaser to the seller, who must store them as proof for audits. Knowing exactly when and how to apply them can be difficult, and mistakes on this front often lead to invoice errors.

2. Value-Added Tax (VAT) errors

The criteria for when VAT is applied is complex. Mistakes made in this area are often due to misinterpretation of the case or oversight rather than typos.

Automated Invoice Processing

Each step of invoice processing contains the potential for mistakes. Approval may also get held up by employees on leave, staff turnover in the accounts payable department, etc.

There is one way to add a degree of stability and efficiency to the process: invoice processing automation.

Automation can speed up and improve collection and processing workflows. It can also automate notifications for internal staff.

Invoice processing software

Using the right invoice processing software can be a game-changer for your business.

While some software will automate the processes listed above, other solutions may include the ability to offer trade credit as part of the invoicing process.

This means that B2B service providers can outsource the entire invoicing and collections process to a third party who underwrites the debt. That way, the seller gets paid within a few days of receiving an order while giving their customers a much longer period to settle their invoice.

Conclusion

Invoice processing includes every step, from receiving invoices to having them paid and recorded in the general ledger.

Though all trends point towards the growth of digital invoicing and invoice processing, paper invoices are still used in some circumstances and need to be scanned into digital form.

The processing workflow requires attention to detail and communication. It’s vulnerable to being held up by mistakes and delays in the approval workflows that exist within it.

Invoice processing automation is one way to significantly improve invoice processing. It reduces the number of potential errors and centralizes communications and approval.

Automation software quickly extracts and records invoice data, including personalized fields. It not only does this quicker than it can be done manually but more accurately, too.

B2B service providers may wish to go further as they consider the type of automation software that best suits their business needs.

B2B sellers can deploy a solution such as TreviPay that offers fully underwritten trade credit at checkout. This option effectively outsources the entire invoicing and collection processes while encouraging higher spending and customer loyalty.

The positive effects of an improved processing workflow can have a dramatic effect on the health and efficiency of your business. Depending on the chosen option, it could also help B2B sellers form closer and more profitable client relationships.