It’s easy to confuse invoice discounting and invoice factoring.

They are both similar – but different – types of invoice finance.

Let’s take a closer look at each one, its advantages, disadvantages and differences, and how you can decide which is right for you…

What is invoice financing?

Invoice finance (/financing) is an umbrella term for business finance methods that leverage outstanding invoices for quick access to cash flow.

You give your invoices to an invoice financing provider who then immediately lends you most of their value in exchange for a fee.

This does not directly affect your client, who should still pay the same amount on the same date. However, it might influence collections of payments in certain ways. We’ll explain more about that later.

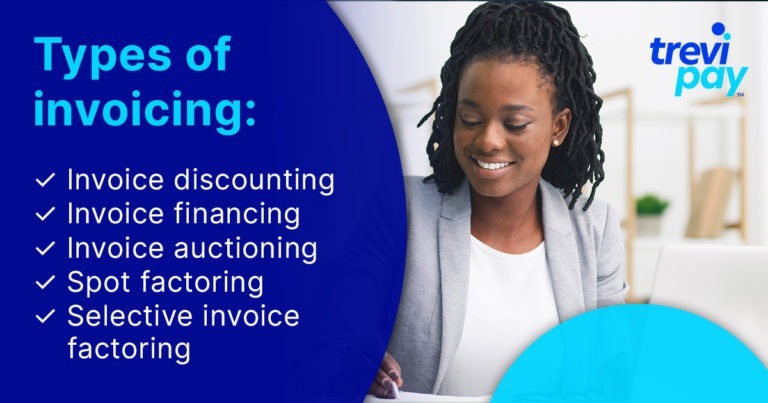

How many types of invoice financing are there?

There are two, five or even more types of invoice financing, depending on how exactly the differences are defined.

The two main types of invoice financing are invoice discounting and invoice factoring.

In addition, the following are also sometimes mentioned:

- Invoice auctioning (invoices are placed on a platform where lenders bid for them)

- Selective invoice factoring (when you select exactly which invoices to factor, rather than just factoring them all)

- Spot factoring (factoring an individual invoice)

You can also further sub-divide invoice financing into recourse/non-recourse, and notification/non-notification options.

However, some argue that these are simply variations of the main two types of invoice financing (invoice factoring and invoice discounting).

Let’s look at the two main kinds.

What is invoice discounting?

Invoice discounting is when you leverage your unpaid invoices as collateral for loans.

You effectively use outstanding invoices as deposits to gain loans from third-party invoice financing providers. This gains you immediate (within 24 – 48 hours) access to most – but not all – of the invoices’ value.

When the invoices are finally paid by your customers, you receive the remainder of its value (minus the discounting fee).

What is invoice factoring?

Invoice factoring is when you essentially sell your outstanding invoices to a third-party invoice factoring provider (also known as a factor).

The factor then forwards most of the value to you immediately (again, within 24 – 48 hours).

Your customer pays the invoice directly to the factor according to the original payment terms. The factor then sends you the remaining value of the invoice, minus their fees.

What are the differences between invoice discounting and invoice factoring?

There are several key differences between invoice discounting and invoice factoring. Some can be seen as an advantage or a disadvantage, depending on the particular circumstances of your business.

1. Fee structure

Invoice discounting costs 0.75 – 2.5% of invoices’ total value. Invoice factoring requires a similar fee (the service fee) plus an administration fee (between 1.5 – 5% of the invoice total).

2. Amount of invoice made available

Invoice discounting involves a basic check of your existing sales ledger in order to determine a variable percentage of your invoices’ total to lend against.

Invoice factoring generally makes between 75 – 85% of the value of your invoices available (provided your customers meet the factor’s requirements).

3. Customer credit vetting

Invoice discounting often requires minimal credit control checks on your customers. Invoice factoring requires more detailed credit and sales ledger checks.

4. Deposit vs selling

Invoice discounting is more like using your invoices as a deposit to gain a short-term loan, whereas invoice factoring is more like selling your invoices.

5. AR Collections & sales administration responsibility

Accounts receivable collections (or A/R) is the process of recovering debts owed to you. Sales ledger administration includes overseeing accounts receivable: checking customers’ credit scores, issuing invoices, recording sales, etc.

Invoice discounting has only a small effect on your collections process and sales administration. Invoice payments either go directly from your client to you or into an account that the provider controls. Either way, it’s still your responsibility to make sure the client pays.

Invoice factoring usually requires the provider to take responsibility for both of these. They notify your client of this and then take over all aspects, including sales ledger administration.

6. Customer awareness of invoice financing

Your customers are unaware when invoice discounting is happening. As far as they are concerned, they are paying you directly.

It’s the opposite case for invoice factoring. The factoring provider will inform your clients that they are taking over the collections process and continue to communicate throughout it.

7. Risk and responsibility for invoice payments

If you are using invoice discounting and your clients don’t pay up, you are still responsible for the invoice value. You will have to make sure customers pay, or you will have to pay back the invoice discounting provider yourself.

Invoice factoring is usually non-recourse (make sure you read the fine-print of anything you need to sign with a factoring provider to ensure this is the case). This means you won’t need to pay the invoice factoring company if the customer doesn’t pay you.

Invoice discounting vs factoring: which option is better?

The answer to this is very much: “It depends …”

Invoice discounting and factoring services are both usually needed for the same reason: you need working capital.

This might be because you are in financial difficulty or because you have an opportunity to grow.

Either way, whether you should choose invoice discounting or invoice financing largely depends on:

- Your collections process: If your collections process is efficient, and will continue to be in the foreseeable future, then invoice discounting is probably a better option for you. If not, invoice factoring is a better choice.

- Your budget: If your margins need to be as low as possible, then invoice discounting is the better option (presuming your collections process is also well-run and sustainable).

If these above points still don’t help you determine which option to choose, consider the following points.

Advantages of invoice discounting vs invoice factoring

Invoice discounting is simpler and cheaper than invoice factoring and it doesn’t affect your reputation or customer relationships. It is also easier to get approval for and because it is usually a non-recourse service, it’s less likely to affect who you can and can’t work with.

Disadvantages of invoice discounting vs invoice factoring

Invoice discounting often provides less of an invoice’s value upfront than invoice factoring does. It also doesn’t come with value-added services such as credit control and collection.

Advantages of invoice factoring vs invoice discounting

Invoice factoring comes with value-added services that free up your resources: credit control and collections services. In some cases, these can lead to customers paying more punctually.

This is because factoring providers specialize in collections and also because customers fear their credit rating will be affected by late payments to a finance company.

Disadvantages of invoice factoring vs invoice discounting

Invoice factoring costs are more complex to calculate and more expensive.

If any of your customers don’t meet their requirements, factors won’t factor those invoices for you. Also, the factor’s collections process might potentially damage your relationship with the client if not carried out in the regular way.

Conclusion

At first glance, factoring and discounting might look like more or less the same thing. After all, both are types of invoice finance that get you access to cash quickly.

However, using the wrong one can have a negative impact on your business.

Invoice discounting is a simpler and cheaper option. It doesn’t interfere with your credit control and collections. Customers won’t be aware that you are using it, so there is no risk to your reputation or business relationships.

Invoice factoring is more expensive than discounting but it also comes with a collections service. This is likely to free up your resources to spend more time on other tasks. It could also lead to each payment arriving sooner.

Choosing the right option with the right provider will maximize your cash flow in the most effective way.