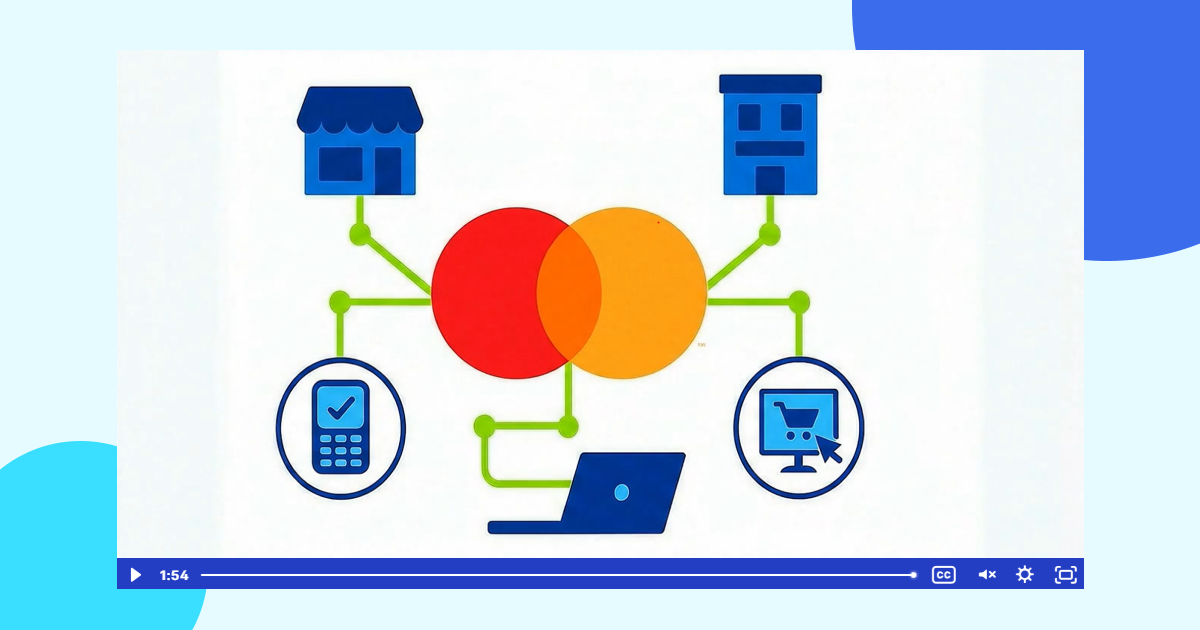

In today’s fast-moving B2B environment, a delayed payment experience can mean a lost sale. With Universal Acceptance—TreviPay’s game-changing B2B payment solution in partnership with Mastercard—you can offer net terms at checkout with the same speed and simplicity as a credit card.

See how Universal Acceptance delivers a frictionless B2B checkout experience with guaranteed payment, real-time invoicing and fast buyer approvals—all with minimal development.

A Flexible, Scalable Net Terms Solution for B2B Sellers

TreviPay’s Universal Acceptance is designed for B2B merchants and manufacturers who want to simplify purchasing for their buyers while maintaining control over accounts receivable and cash flow.

By integrating with the Mastercard network, Universal Acceptance allows businesses to extend net 30, net 60 or custom terms at checkout—without the complexity or credit risk of traditional trade credit programs.

Whether you sell through eCommerce, in-store or via inside sales teams, TreviPay’s B2B payment solution enables:

- Fast buyer onboarding and instant credit decisions

- Co-branded buyer portals for account and payment management

- Automated invoicing delivered into buyer A/P systems in their preferred format

- Guaranteed payment on every invoice, with zero credit risk for sellers

- Rapid deployment with minimal IT involvement, often plug-and-play if you already accept Mastercard

Why Universal Acceptance Works for Modern B2B Commerce

- Optimize your B2B payment processing with built-in credit risk protection

- Reduce friction at checkout with embedded payment terms

- Improve buyer experience while gaining control over payment timing

- Launch faster than traditional A/R automation solutions

- Leverage the strength of TreviPay and Mastercard’s global B2B payments infrastructure

Get Started with Universal Acceptance

Universal Acceptance is the fastest, easiest way to launch a scalable net terms program without sacrificing cash flow or operational efficiency.

Ready to modernize your

B2B payment experience?

Contact TreviPay to learn

how to get started.