TreviPay’s Universal Acceptance solution combines the power of Mastercard’s network with TreviPay’s B2B payments technology to deliver scalable, closed-loop, net terms-based purchasing experiences. Drive sales, improve cash flow and accelerate onboarding—all with minimal integration effort.

Universal Acceptance* simplifies B2B transactions at scale by combining TreviPay’s managed services and payment platform with the global reach of the Mastercard network. Buyers benefit from fast onboarding and a seamless, flexible purchasing experience—while sellers gain predictable cash flow with guaranteed payments and minimal integration. The result: transparency and control for buyers, and scalable growth for you.

If you already accept Mastercard, you can utilize Universal Acceptance for rapid market entry and implementation. Deploy the solution across all merchant locations and channels with minimal integration.

Eliminate collections risk. TreviPay ensures predictable DSO by guaranteeing payment—helping you stay financially agile while delivering terms to buyers.

This closed-loop Pay by Invoice solution increases order volume and fosters buyer loyalty by offering net terms of 30, 60 or 90 days. Unlike standard card payments, TreviPay provides detailed, line-item invoicing and Level III data, giving buyers the visibility and control they need to manage budgets and streamline reconciliation.

Offer the simplicity and trust of a Mastercard-enabled payment experience, while TreviPay's technology platform preserves the controls and oversight buyers need from a net terms program.

Watch the video to explore how TreviPay’s Universal Acceptance enables sellers to offer net terms at checkout with the speed and simplicity of a credit card. No delays. No credit risk. Just frictionless B2B commerce.

Universal Acceptance brings together a co-branded payment experience, fast onboarding and ERP-integrated invoicing to simplify B2B purchasing, while giving buyers and sellers what they need to succeed.

Buyers are approved in as little as one day and immediately issued Mastercard-branded commercial card credentials for use across all channels.

Enable purchases online, in-store or via sales reps with consistent experiences. Universal Acceptance increases buyer confidence and drives adoption across all sales touchpoints.

Issue invoices at checkout with built-in contract price verification to reduce disputes. Buyers get the convenience of a commercial card without sacrificing the accuracy, oversight or invoicing control their business requires.

Invoices feed directly into buyer ERPs (EDI, XML, cXML), enabling three-way matching and SKU-level detail for seamless reconciliation and simplified PO management. This data also flows into downstream A/P and expense management platforms—like Coupa and others—ensuring full visibility and continuity across finance workflows.

Ensure guaranteed, on-time settlement in sellers’ preferred currency and timeline. TreviPay removes guesswork from cash flow planning with reliable DSO performance.

TreviPay delivers a co-branded experience with your business at the forefront. Buyers manage payments, disputes and credit lines in their preferred currency and timeline all in a self-service portal designed to reduce friction and enhance satisfaction.

Learn how to bridge the gap between what buyers expect and what suppliers can provide by modernizing B2B commerce.

Discover how Universal Acceptance simplifies B2B expansion with an easy integration for flexible terms across all channels.

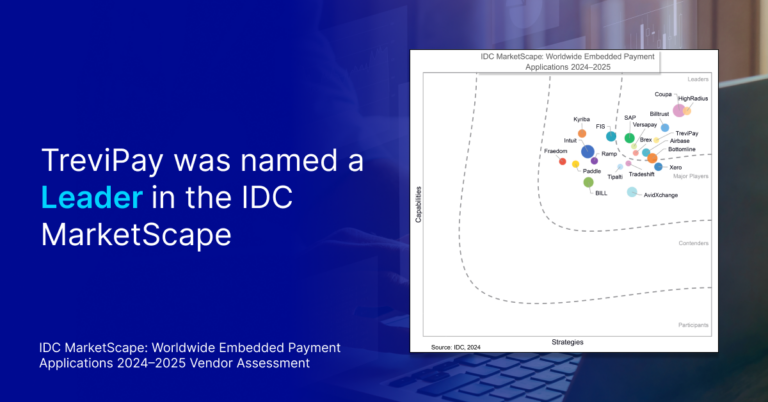

Explore why IDC named TreviPay as a leader in the embedded B2B payment space in this exclusive analyst report

Explore how Universal Acceptance transforms B2B transactions with Mastercard-backed acceptance, scalable onboarding and net terms flexibility—without compromising on speed, control or buyer experience.

Yes, Universal Acceptance is embedded payments in action. It combines TreviPay’s B2B platform with Mastercard’s network to power net terms at scale, with minimal integration. Buyers can complete transactions through your sales channels without being ever being redirected.

Universal Acceptance goes beyond virtual cards. Approved buyers get physical and virtual cards to purchase on net terms across all sales channels—just like with traditional credit cards. Sellers get guaranteed reimbursement while TreviPay assumes credit risk and manages collections.

Universal Acceptance enables net terms transactions to be facilitated over Mastercard’s Network. This empowers sellers to quickly launch a net terms and invoicing program with TreviPay with minimal integration work, as long as you already accept Mastercard card payments.

Universal Acceptance is an omnichannel solution, meaning that net terms transactions can occur on any of your purchasing channels: in-store, over the phone, online and even via ERP.

Yes, to utilize TreviPay’s Universal Acceptance solution, your business must accept Mastercard. This requirement ensures rapid and simple integration, allowing you to quickly extend net terms financing to your B2B customers with minimal technical setup, offering the convenience of credit card payments and the versatility of TreviPay’s Pay by Invoice.

Universal Acceptance is ideal for B2B businesses in retail, manufacturing and corporate travel. It’s also great for companies with multiple sales channels or locations due to easy implementation. It enables fast onboarding, streamlined net terms, and broad acceptance via Mastercard.

If your business already accepts Mastercard, implementation is straightforward, just provide TreviPay with the Merchant IDs you’d like to use for Universal Acceptance transactions. To support Level III data, you’ll also need to pass that data along. If that’s not possible, we can collect it through alternative methods such as receipt information or API. This streamlined approach minimizes implementation time and upfront costs, enabling fast onboarding and seamless transactions via the familiar Mastercard Network.

Yes, Mastercard transactions are secure. Universal Acceptance leverages Mastercard’s global payment network, ensuring that all transactions are authorized, cleared, and settled using established, secure infrastructure. Additionally, TreviPay implements industry-standard measures to protect personal information from unauthorized access, use, alteration and disclosure .

Universal Acceptance supports global B2B commerce with features like multi-currency support, localized invoicing, and region-specific compliance to facilitate seamless international transactions.

Universal Acceptance integration is fast and simple, just share your Mastercard Merchant IDs. In contrast, TreviPay’s standard implementation offers fully customizable, end-to-end platform integrations designed for businesses with more complex requirements.

Universal Acceptance is ideal for merchants needing fast, easy B2B payment acceptance. All-in-One Payments offers a more robust solution with payment orchestration options for integrated card processing.

Looking for tailored payment solutions? See how TreviPay’s embedded payments, credit management

and global invoicing solutions can transform your business.

TreviPay streamlines B2B payments with net terms, integrations and guaranteed payments for growth.

TreviPay automates accounts receivable to streamline credit, invoicing and collections for maximum efficiency.

TreviPay’s credit decisioning uses 30+ databases for instant risk assessment and compliance checks.

TreviPay manages collections, automates workflows and protects relationships as you scale.

TreviPay boosts invoicing efficiency, cuts manual tasks and ensures global billing compliance.

TreviPay drives B2B digital transformation by automating payments and invoicing for seamless scaling.

Want to simplify B2B purchasing? Download our Universal Acceptance eBook and learn how to pair credit card ease with net terms control to drive buyer loyalty, improve cash flow and accelerate growth.

*Universal Acceptance is protected by a patent application in the U.S. and elsewhere for TreviPay, owned and operated by Multi Service Technology Solutions, Inc. See www.trevipay.com/patents for more information.