The business sector underpins the world’s economy. By some estimates, it makes up 72% of the OECD’s total GDP.

Businesses can be categorized in two main ways, based on what type of market they serve.

- Business-to-business (B2C): Businesses that sell goods or services directly to consumers.

- Business-to-business (B2B): Businesses that sell to other businesses.

The B2B eCommerce market is predicted to grow approximately 18% annually between 2004 and 2030. This is all made possible by B2B payments.

But what exactly are B2B payments?

B2B Payments Definition

Business-to-business (B2B) payments are transactions for funding exchanges of goods or services directly between businesses.

They take place within and across all industries. They often involve wholesalers, manufacturers, retailers and service providers, small businesses, and enterprises.

And they use multiple payment methods and payment cycles

In short, B2B payments aren’t a single category. Despite this, ‘B2B payments‘ is still a useful phrase. This is because there are certain features that B2B payments tend to have in common, especially in comparison to B2C payments.

How do B2B Payments Work?

The B2B payments process technically begins when invoices are issued and processed.

Payments are often completed using checks or bank transfers, including via automated clearing house, which can take a few days to clear.

Collections of these payments are relatively slow (though there are B2B collections best practices businesses can follow).

Firstly, late invoice payments are common. In the UK, for example, the average SME is chasing after five outstanding invoices at any given time, which amounts to a value of GBP £8,500.

Secondly, buyers typically need to offer net terms or financing options (see below, ‘B2B financing’) in order to gain sales.

Directly offering financing effectively amounts to sellers giving buyers interest-free loans in exchange for risk, additional administrative costs, and a negative impact on their own cash flow.

Sellers can overcome this in one of two ways: by taking out a business loan/financing for themselves or working with a third party to offer customers financing.

Advantages of Managing B2B Payments With a Provider

Using a third-party B2B payment solution like TreviPay offers businesses several key advantages:

- Lower Admin Costs and Reduced Risk: Advanced fraud and risk management systems minimize exposure to payment fraud and errors, ensuring more secure transactions.

- B2B Credit Management: With trade credit services, businesses can improve cash flow and better manage credit terms with their customers.

- Improved Payment Options: Utilizing global invoicing solutions and managed receivables allows businesses to streamline their payment processing and financing capabilities.

- Cost vs. Benefit: While providers may charge setup and transaction fees, these are typically outweighed by the increased sales and order volumes facilitated by improved payment processing.

- Expertise and Best Practices: TreviPay offers deep expertise in the B2B payments and financing landscapes, helping businesses implement best practices and navigate complex payment environments.

The Most Common B2B Payment Methods in 2024

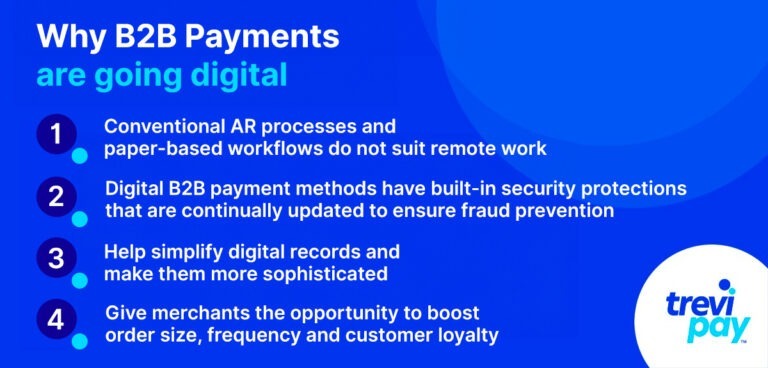

Most B2B payment processing is still done by conventional methods. However, B2B payment trends are steadily moving toward digital and automated payment models. The ability to offer customers their preferred payment method is essential.

Common B2B payment methods:

- ACH payments

- Checks

- Cash

- Wire transfers

- Credit cards and virtual cards

The B2B Payments Landscape Today

B2B transactions have traditionally been unique for the reasons outlined above.

However, all B2B buyers are B2C buyers, too. Our research found that 80% of B2B buyers admit their buying experiences elsewhere impact their expectations for business purchases.

Most B2B payments, therefore, aspire to be frictionless and simple experiences. In other words: businesses have accelerated their migration toward automated B2B payment solutions to reduce administrative work and costs.

The average U.S. business using paper-based payment processes could have as much as 24% of its working capital tied up in net terms. And nearly half (49%) of invoices generated by U.S. businesses are paid late – this takes up the accounts receivables department’s time and some become uncollectible.

Using an automated payment system can reduce manual processes, labor costs, and paper wastage!

B2B Payments Trends

This means there is a big opportunity for suppliers who get ahead on this front.

Though the below trends all point in the same direction, they are worth considering one by one.

B2B Payment Options

Digital payments are increasingly important in B2B. Our research found that 50% of all B2B buyers think vendors should offer more B2B payment options.

Point of sale (POS) integration is a great way to add consistency to your payment methods across platforms and locations.

Cross-border payments also matter. Being able to accommodate the payment methods of different countries may be the only barrier to sales in many cases and the cause of multiple abandoned carts.

B2B Marketplaces

B2B marketplaces are digital platforms that specialize in serving multiple vendors and buyers.

From the vendors’ perspective, joining a B2B marketplace can be an effective source of qualified leads.

For buyers, it offers a convenient platform that – unlike B2C platforms – is structured to process B2B transactions.

Depending on the platform, this could include features such as cross-border payments, net terms, bulk buying discounts, automated stock replenishment, etc.

Embedded B2B Payments

Embedded payments generally refer to payment options embedded into online platforms and business processes such as apps and websites.

They are essentially the ‘buy now’ buttons popularised by eCommerce platforms such as Amazon, which can be set up quickly and then used with a single click thereafter.

As embedded payments have proliferated online channels, B2B buyers – like everyone else – have come to expect it.

B2B Financing

B2B financing is a unique field inextricably linked to B2B payments. Like financing, more generally, when it works well, it increases conversion rates and order values.

Common types of B2B financing include:

- Bank loans.

- Venture debt.

- Accounts receivable financing.

- Invoice factoring.

- Credit lines.

Businesses generally have a choice between going to traditional banks or alternative lenders for financing.

Applying to banks can be more time-consuming and likely won’t come with the added expertise that a specialist B2B payment solution brings.

Embedded financing is financing offered at the point of sale, especially for online payments.

Buy Now, Pay Later (BNPL)

BNPL is a form of short-term financing that enables buyers to pay for purchases in installments.

It has gained popularity – and created some controversy – in the B2C world in recent years. And now it is now increasingly being adopted in B2B, where it is fundamentally different in some key aspects.

B2B BNPL is about preserving cash flow that can then be re-invested into businesses.

The Future of B2B Payment Processing

Conventional B2B payment methods like ACH, checks, and credit cards are likely to decline in the coming years.

Innovative B2B payments solutions are increasingly integrating the best of B2C payment models with the specific needs of B2B business transactions, i.e., simple, fast, and convenient payments. These include:

- Extending B2B trade credit

- Decreasing companies’ days sales outstanding (DSO)

- Increasing efficiency in cross-border purchasing

Some enterprises are already using new types of B2B automated payment systems to accelerate growth and reduce costs by partnering with B2B payments experts.

TreviPay’s B2B Payment Solutions

TreviPay offers B2B payment solutions designed for scalability and business growth.

We enable your business to provide its buyers with a range of payment, financing and real-time invoicing options at checkout across all sales channels.

Our retail platform for B2B simplifies the invoicing process and supports Level 3 data requirements. It reduces disputes through integrated purchase controls and enhances the customer experience.

Our APIs facilitate easy integration with eCommerce platforms, accounting software, and payment gateways. This ensures consistent brand representation throughout the entire B2B buying journey.