The freight forwarding market is currently valued at approximately 6.1 trillion USD. And one recent report forecasts a 3.7% compound annual growth rate (CAGR) for it by 2026.

It’s a highly competitive and time-sensitive industry. There are approximately 106,000 freight brokerages and agencies in the US alone. If you can’t connect shippers and carriers quickly enough, another broker will…

You need to pay carriers faster than shippers pay you. So, one big hurdle to scaling your freight brokerage is cashflow.

One of the simplest and most efficient ways to overcome this is by working with a freight broker factoring provider.

But what is freight broker factoring and is it worth it?

What is freight broker factoring?

Freight broker factoring (also known as trucking factoring) is invoice factoring for freight brokers.

Factoring (also known as invoice factoring) is a financing technique where a company hands its unpaid invoices over to a third-party factoring company in exchange for most of the invoices’ value (usually 75 – 85%) being paid upfront.

Once the invoice has been paid by the company’s client, the factoring company then pays the remaining balance to the first company (minus its fees).

Invoice factoring itself takes place across many industries. However, freight broker factoring providers are specialists with freight brokering.

They understand the average costs and payments terms of shippers and carriers, the demand and rate fluctuations, related freight bills, etc.

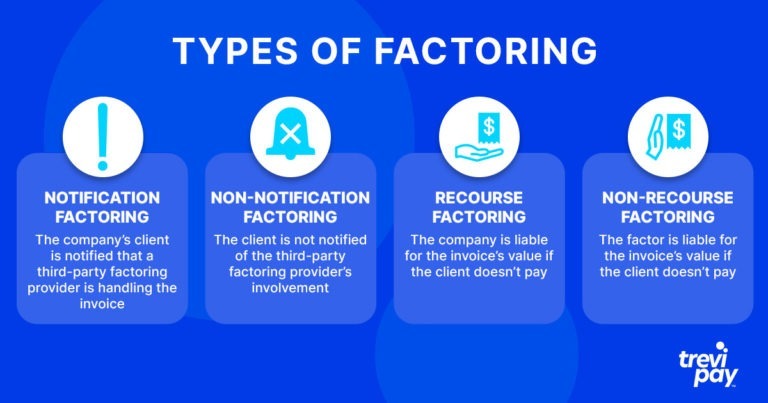

There are variations to factoring more generally that are worthwhile noting. These include:

- Notification factoring: The company’s client is notified that a third-party factoring provider is handling the invoice

- Non-notification factoring: The client is not notified of the third-party factoring provider’s involvement

- Recourse factoring: The company is liable for the invoice’s value if the client doesn’t pay

- Non-recourse factoring: The factor is liable for the invoice’s value if the client doesn’t pay

Of these, non-notification non-recourse factoring is the most ideal kind for freight brokers. We’ll explain why later on in this article.

How does the freight factoring process work?

The freight factoring process involves interactions between three parties: You (the freight broker), your client, and the factoring company.

You send your invoice onto the factoring company, who pay you 85% (for example) of its value within 24 hours of receiving them.

You use this advance to cover business costs. 30 days after you’ve issued your invoice, your client pays the factoring company the full amount. The factoring company keeps their discount fee (usually 3% of the total of the invoice) and service fee (2%) and sends you the remaining 10% of the invoice.

Advantages and disadvantages of factoring for freight brokers

Freight broker factoring is a useful tool to help navigate the industry’s changes and drive growth. But in what ways exactly does it help and where’s the catch?

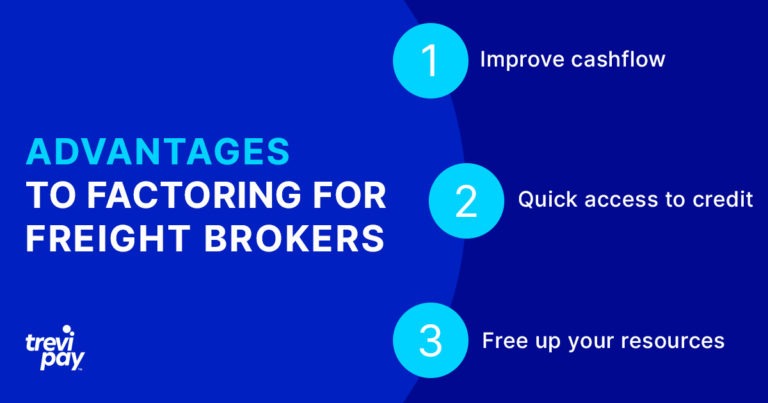

Advantages

There are two main benefits to using factoring companies. The first is more widely known, the second, less so.

1. Cashflow

This is the top-level, clearest advantage to factoring. Improving your working capital allows you to pay your carriers, cover fuel and other expenses.

Many shippers offer 60 or even 90 days payment terms (also known as net-60 or net-90) and will not advance payments. But most carriers need to be paid sooner than this: usually within 30 days.

Factoring enables you to bridge this gap.

Most factoring companies will pay you the value of the invoice you have issued to your customer right away (within 24 hours of you issuing it). This enables you to take on new clients in a shorter timeframe, make more carrier payments and cover more freight bills (including fuel).

2. Quick access to credit

To get started with a factoring brokerage is simple. Many will be available to apply for 24 7 (online). They use automated software to do more or less immediate credit checks and give a free quote.

This contrasts with other ways to get funding, such as traditional business loans (see below). With today’s ever-evolving financial technology, more providers and services are appearing. This helps you choose from a range of rates and other options.

3. Freeing up your resources

The majority of freight brokers’ time is spent looking for carriers and following up with customers. These are time-intensive and time-sensitive tasks.

Spending energy on chasing invoices and planning around a lack of cash flow is a distraction from your core business of freight brokerage.

One lesser-known advantage of factoring is handing over your collections process.

For busy companies enjoying rapid growth, freeing up staff to focus on the core parts of the business is crucial. Many factoring companies will also be experienced and efficient at collections.

Disadvantages

Factoring isn’t for everyone. Some freight broker industry experts are even vocally against it. Below is our list of potential disadvantages of freight factoring.

1. Cost

As a freight broker, you make your money in the margin between what the shipper pays you and what you pay the carrier. This varies between loads, routes and suppliers. You also have many other costs to consider.

It can be more expensive than other forms of financing. This will be especially apparent when costs are high, as happens relatively regularly in the industry. So, long-term, the cost of factoring will add up.

2. Financial risk (in some cases)

Many customers won’t default on their invoices. After all, they have a strong incentive not to: reputation. Few freight brokers will want to work with clients who do this.

However, this doesn’t mean that none ever will. This is especially risky if for you if you are using a recourse factoring service.

You may even find yourself in a situation where you owe your factor the cost of a defaulting client’s invoice plus the factoring fees. Even though your factor approved the customer based on credit checks and itself may have receivables insurance…

3. Reputational risk

Some factoring companies are overzealous in their collections efforts.

They may surprise and even alienate customers who are used to a more relaxed payments process with the prompt, pushy nature of their payment demands.

But even if this isn’t an issue, the very fact that your customers know you are using a factoring service may cause them alarm.

There is no reason it should do and you can take mitigating steps (by sending communications outlining your reasoning, etc.).

However, this aspect will always be slightly beyond your control, unless you are able to find a non-notification provider.

How to choose the right factoring company?

It’s crucial that you read the fine print of any factoring provider’s contract. One specific detail to clarify is whether or not they are offering recourse or non-recourse factoring (mentioned above in the ‘What is freight broker factoring?’ section).

You need to ensure that you will not be in a position where you end up having to pay for any customers’ mistakes.

In summary, the best kind of factoring service freight brokers should look for is non-notification and non-recourse factoring.

How much does factoring for freight brokers cost?

The precise cost any given factoring fee depends on several elements. They usually vary between 2.5 – 5% of the invoice’s total value.

Whether or not this is worthwhile depends on what your carrier payment is – and as we know, this can vary greatly.

It’s always worth considering several factoring companies. Many offer a free quote, which you can compare with their competitors.

What are the alternatives to factoring?

Perhaps factoring isn’t for you. But you may still be looking for other ways to improve cash flow. There are many other financing options still available, including:

Invoice discounting

Invoice financing also includes invoice discounting. The latter is a simpler form of invoice financing that enables you to still remain in control of the collections process.

Lines of credit

A line of credit is a pre-fixed amount that a lender can assure you. It acts like an overdraft, to be used if needed.

In order to secure these from a shipper, brokers may need excellent credit records and a long working relationship.

Business loans

Traditional business loans can offer better rates than factoring companies. However, they require more time barriers to entry. This is not ideal for new brokers.

Conclusion

As a freight broker, you provide a vital service: ensuring the world’s cargo gets to its destination.

You have to do this in a fragmented but fast-growing market, whilst maintaining a balance in between shippers and carriers and adapting to unexpected external events.

Using a freight factoring company is a tool for dealing with these changeable circumstances. It can improve your cashflow and free up your resources.

This is especially useful if your company is growing fast, as it enables you to pay carriers, fuel, freight bills and other expenses whilst you wait for the shipper to pay you.

Factoring services aren’t without their potential drawbacks though. Long term, their cost adds up, and in some circumstances you may be liable for your clients’ failure to pay.

You might also risk damage to your reputation if the factoring company is too aggressive in its collections efforts.

This means you should always choose the factoring company you work with carefully. And read the fine print of every contract. Ideally, a non-recourse and non-notification provider would be best.