Without needing to open new stores or offices to diversify revenue streams, you can lower the risk of international expansion while accessing more buyers through eCommerce. Online markets will provide access to an estimated 4.7 billion shoppers by 2028 – more than 40% of the world’s population.

By 2029, global B2C eCommerce revenue is forecast to exceed $5 trillion, while the global B2B eCommerce market may be valued at a whopping $36 trillion by 2026.

However, venturing into international eCommerce has its pitfalls.

From complying with regulations to understanding customer preferences across regions, those who prepare and adapt to selling on the global stage stand the best chance of success.

Tapping into this vast market requires a detailed international eCommerce strategy. In this article, we’ll explore the benefits of cross-border eCommerce, the challenges and how to approach a global expansion strategy.

What is Global eCommerce?

Global eCommerce is the business of selling goods or services online across international borders. It extends beyond the transaction to include online marketing and brand building to attract global customers.

Cross-border eCommerce occurs either business-to-business (B2B), business-to-consumer (B2C) or business-to-government (B2G). Transactions range from consumer purchases to B2B sales, including vendor transactions within a retail supply chain. The goal is to establish an online presence that can effectively engage and convert international buyers.

A successful international eCommerce strategy factors in customer needs, preferences and behaviors in each target market. Although a primary objective of global eCommerce is to grow sales, developing worldwide relationships can also improve sourcing capabilities and partner networks.

Supporting cross-border eCommerce involves managing logistics such as:

- Onboarding

- Supply chain production

- Invoicing

- Freight

- Compliance with local regulations

- Taxes and tariffs

- Trade credit

- Payments

Benefits of a Global Expansion eCommerce Strategy

Expanding your eCommerce operations requires technology investment and operational strategy to fuel growth and scalability.

Expand Market Reach

One of the highlights of successfully executing a global eCommerce strategy is expanding your customer base. For both B2B and B2C companies, this comes from access to a wider pool of potential business customers and suppliers. Typically, the B2B eCommerce market dwarfs the B2C market, for example the B2B market is 1.5 times larger than B2C in the U.K., yet it’s lagged somewhat in development.

The pandemic catapulted online purchases, as revenue from digital channels went from 12.2% of U.S. B2B sales in 2020 to 14% in 2023, and 33% for U.K. businesses in 2021 to 46% in 2023.

According to the IMF, the pandemic-led adoption of eCommerce appears to be especially long-lasting in categories of retail, including department stores, electronics and clothing. This may be because industries with less digital maturity, like retail and healthcare, have more room to expand eCommerce.

Establishing a presence in international markets extends your credibility on a global scale.

Diversify The Risk

Create a safety net to manage local market uncertainties.

Selling in multiple markets diversifies your revenue streams and provides protection against economic downturns or instability specific to a region. This is especially important for businesses with a B2B focus that may target fewer high-value customers.

By conducting business across different countries and regions, you can reduce the impact of localized economic challenges to build a more stable and resilient business.

For example, in 2022 Chinese domestic online retail revenue remained essentially flat, but its international retail segment saw revenue increase by 8.3% year over year. Heated competition in China contributed to the gap and favored retailers who made the leap abroad.

Achieve Economies of Scale

Economies of scale lower per-unit costs, by spreading expenses over increased production volumes.

As you grow your global market presence and increase orders, you can achieve scale in procurement, production, shipping, or overhead costs. Bulk purchasing provides the bargaining power to further optimize costs.

Beyond increasing production, consolidating resources also improves efficiency.

For many businesses, the memory of supply chain bottlenecks and energy scarcity from the pandemic and geopolitical conflicts remains fresh.

To address cost increases in raw materials and production, businesses in Europe have been transforming the way they operate by shifting toward eCommerce. eCommerce lowers energy consumption compared to traditional brick-and-mortar while simultaneously supporting sustainability goals. The pressure to decarbonize is notable in the EU retail and wholesale sector, which contributes about 40% of overall EU greenhouse gas emissions.

Cost efficiency, in turn, allows you to offer more attractive prices to your customers while maintaining healthy profit margins.

Increase Revenue

Cross-border sales offer a promising avenue for revenue growth.

International eCommerce retail sales are predicted to grow by more than 11% in 2024 and reach $6.35 trillion by 2027. B2B eCommerce sales exceeded an estimated $2 trillion in 2023, on track to reach $3 trillion by 2027.

The growing market is deeply rooted in buyer behavior worldwide. The percentage of shoppers who buy products through cross-border eCommerce starts at 67% in Thailand, followed by Australia, Saudi Arabia, Germany, the U.S., Brazil and 48% in the U.K. The impact filters through to the top line – in Germany, the online share of B2B business makes up around two-thirds of revenue.

Expanding your business into new markets taps into this increased spending, boosting your top-line revenue.

Create Brand Visibility

Establishing an international eCommerce presence raises your global visibility.

The importance of an online channel is clear – 99% of shoppers research online before going in-store at least some of the time. 92% of shoppers research purchases online even while shopping in-store. Taking your brand worldwide as part of a global expansion strategy improves your odds of new customer exposure.

Showcasing your brand not only attracts new customers but also potential partners and investors.

Improve Competitive Advantage

Beating competitors in key international markets requires prioritizing customer needs so they keep them coming back. For example, expectations have grown about the accessibility and ease of buyer experiences.

As a result, the top 10 retailers have been actively boosting digital capabilities by offering seamless omnichannel experiences offline and online – being available to everyone, everywhere, all at once.

As 83% of B2B buyers primarily interact with sellers digitally, B2B commerce is transitioning to a digital-first approach. With that in mind, B2B buyers expect the smooth self-service experience we take for granted in B2C. This requires a tightly orchestrated digital sales experience, from when a buyer first comes into contact with your products to checkout and payment.

This provides the opportunity to optimize payment processes specifically for B2B buyers. For example, potential customers seeking vendors that offer 30-, 60- or 90-day payment terms at checkout. Delivering tailor-made B2B purchasing experiences positions your business to convert and retain customers.

Challenges of Global Cross-Border eCommerce

Pursuing a global expansion strategy can be rewarding, but that doesn’t mean it’s straightforward.

55% of businesses find cross-border eCommerce operationally difficult. This is especially true when managing supply chains, compliance and cross-border payments.

Here are some of the key challenges.

Cross-Border Taxes, Tariffs & Other Regulations

Navigating international trade laws and regulations can be daunting for businesses participating in cross-border eCommerce.

Each country has its own set of rules and requirements governing taxes, tariffs, and compliance. Companies need to thoroughly research and understand these obligations before expanding into new markets.

Customs regulatory compliance is particularly complex, with 41% of businesses struggling to accurately classify their products using the Harmonised System (HS) codes. HS codes are essential for assigning the correct product duties and taxes.

Although a moratorium on global eCommerce tariffs has been extended until 2026, companies may need to pay additional charges once a global agreement is in place.

Other applicable taxes include value-added tax (VAT) or the U.S. sales tax, which varies by state and can be complex for both U.S. and non-U.S. suppliers. The U.S. has an overwhelming 13,000 taxing jurisdictions.

One solution is to leverage electronic invoicing to update other systems, including your tax management software.

eInvoicing

Governments around the world have begun mandating electronic invoicing to efficiently impose and collect taxes.

eInvoicing transfers invoices digitally, reducing unnecessary paperwork but also supporting controls to monitor, validate, and report business transactions in real-time.

More than 50 countries have already introduced B2B or B2G (business to government) eInvoicing and more are likely to follow suit. For example, the eInvoicing Directive in the EU requires all public sector entities to receive and process electronic invoices.

Even though eInvoicing helps with tax compliance, you face roadblocks like:

- Different invoice standards and formats

- Lack of harmonization and different legislation in each jurisdiction

- Lack of internal systems to support eInvoicing

Businesses can engage in cross-border eCommerce by using modern invoicing platforms that support wider compatibility and comply with varying regulatory requirements across multiple jurisdictions. Without a compliant eInvoicing system, global companies can run up additional costs processing invoices or regulatory penalties. Before you can properly scale, you’ll need to address these operational obstacles.

Cross-Border Payments

Amid strong volume growth, cross-border payments trigger challenges ranging from execution to fees and compliance.

B2B eCommerce is already the second largest segment of retail cross-border payments in 2023. By 2030, it will likely be the biggest category. Given the mounting expectations for frictionless online transactions, buyers and sellers need a secure and reliable way to handle cross-border eCommerce payments.

Moving funds across international borders can be notoriously unreliable, with the underlying issue difficult to find and resolve. In fact, according to PYMNTS, the average payment failure rate is 11%, costing U.S. merchants at least $3.8 billion in lost sales in 2023.

Not only are payment failure rates high, but costs add up. For example, after the U.K. exited the European Union, Visa and Mastercard raised interchange fees significantly, prompting the British regulators to explore capping transaction fees.

As faster settlement and better customer experience remain a higher priority, businesses are looking for alternative solutions beyond traditional banking products that lag in these areas.

Partnering with payment solutions or payment orchestration platform that offer tools and expertise in cross-border payments helps avoid errors and lost revenue. A dedicated payment provider can offer automated payment recovery solutions, avoiding costly manual outreach that requires contacting the customer by email, or app.

A global payment orchestration platform serves as a centralized hub, integrating multiple payment methods, currencies and regulatory requirements across borders. This unified approach simplifies complexity for businesses operating on a global scale, facilitating smoother transactions and enhanced operational agility.

Localized Payments

An effective international eCommerce strategy needs to take into account local preferences for payment methods.

For instance, Alipay and WeChat Pay are the main payment platforms in China, whereas Paytm Wallet is more prevalent in India. U.K. buyers overwhelmingly prefer to pay with cards, while Germans primarily use e-wallets like Paypal.

Supporting locally preferred payment options reduces friction for converting international customers. Offering these payment options is the only way to fully reach local customers.

Businesses often collaborate with payment partners like TreviPay to support payment localization. TreviPay simplifies cross-border transactions, enabling businesses to offer locally optimized payments across different jurisdictions.

Multi-Currencies & Foreign Exchange Rates

Selling globally means managing multiple currencies and the price swings of foreign exchange rates. These fluctuations can significantly impact profit margins, pricing, and the overall health of company finances.

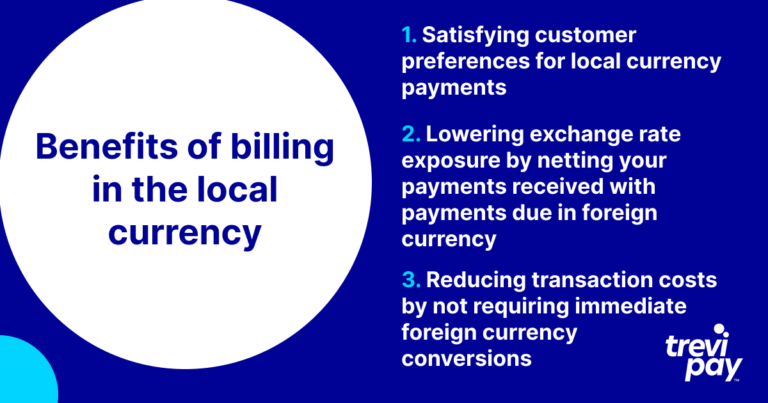

Typically, the optimal approach starts with billing customers in local currency. Benefits include:

- Satisfying customer preferences for local currency payments

- Lowering exchange rate exposure by netting your payments received with payments due in foreign currency

- Reducing transaction costs by not requiring immediate foreign currency conversions

Working with payment partners helps to consolidate transactions, reduce foreign currency conversion costs and combine cash available in different currencies. By streamlining currency management, payment solutions allow you to focus on your business instead of dealing with foreign exchange risk.

Buyers also expect multiple payment acceptance methods in various locales, which requires a payment solution capable of handling that complexity.

Delivering advanced payment systems customized for regional markets helps maximize revenue.

Global Credit & Payment Fraud

Fraud is an ever-present risk that escalates with cross-border transactions.

The Association of Certified Fraud Examiners (ACFE) estimates businesses worldwide lose 5% of their annual revenue to fraud. A surge in payments usually leads to increased fraud.

Scammers cast a wide net — 98% of manufacturers, retailers, and B2B marketplaces have all been victims.

The impact is measurable and significant. Research suggests that in 2024, retailers are likely to lose $25 billion due to payment fraud.

As technology evolves, so do the methods of deception. Global fraud attacks continue to increase and advances in artificial intelligence have created new and easier methods for threat actors. As many as 52% of businesses expect generative AI to lead to more cyber attacks in the next 12 months.

As businesses grapple with advanced threats, many still rely on outdated defenses. Reliance on manual verification and address matching not only takes more time to review transactions, it also hurts customer acquisition.

54% of companies using manual credit verification to detect fraud believe that they have turned away legitimate buyers due to false red flags. An effort to increase fraud prevention should not come at the price of growth.

Deploying an automated payments solution adds controls and checks to payment processes. Secure, scalable payment solutions like TreviPay work in the background to protect businesses from fraud.

Localization

Effectively engaging global customers means adapting your selling channels to each locale’s linguistic and cultural norms.

In a survey, 84% indicated that localization grew revenues. 66% of B2B buyers are likely to pay more for a localized product because they need a reliable product that connects well with other solutions and is easy to use long-term. Other positive effects of localization include reaching and keeping new customers, along with standing out from the crowd.

Localization vs Translation

The distinction between localization and translation is often misunderstood.

Translation focuses on converting spoken or written text to another language. Accurate translation paves the way for a smooth, frictionless purchasing experience from the shopfront to checkout. This also reduces strain on customer service, ensuring buyers have accurate information throughout the payment process.

CSA Research found that 76% of online shoppers prefer to buy products with information in their native language. As part of customer expectations of a high-quality experience, German consumers expect online stores and websites to be in German, for example.

Localization, however, goes beyond translating your content into local languages. It involves tailoring everything from product sizing to imagery and brand messaging to each target market and culture. Localization also involves adapting to local preferences and consumption habits or conforming content to follow local customs and regulations.

Aligning checkout processes with local needs drives sales and encourages repeat business.

Customer Loyalty in the B2B Industry While Expanding Internationally

Not only does retaining customers drive sustainable growth, but it lowers costs. Deloitte research shows that the acquisition cost for a new retail customer is six to seven times higher than retaining an existing customer.

To build strong relationships with buyers, sellers must understand customer needs and establish trust. This involves identifying the most convenient ways for buyers to transact.

For example, 75% of B2B buyers prefer a digital purchasing experience without an in-person representative, according to Gartner. Sellers that create seamless buying experiences online can capitalize where competitors are falling behind.

Loyalty Begins at the Payment

Loyalty stems from providing exceptional value.

Customers prioritize a convenient, personalized, and frictionless payment experience. However, delivering a first-class payment experience starts before the final checkout.

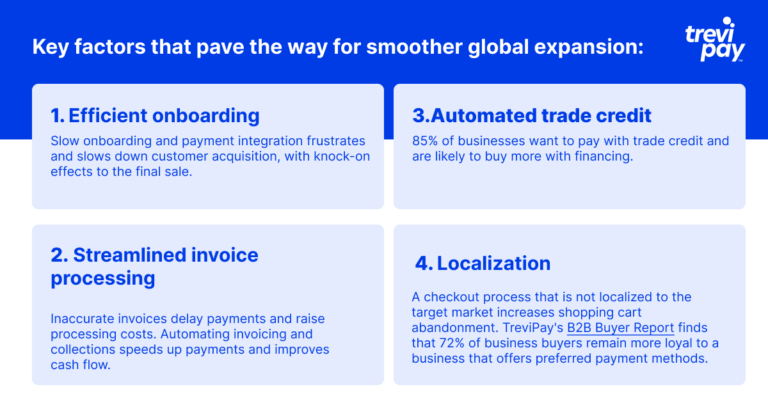

Here are key factors that pave the way for smoother global expansion:

- Efficient onboarding – Slow onboarding, credit checks and payment integration frustrate and slow down customer acquisition, with knock-on effects on the final sale.

- Streamlined invoice processing – Inaccurate invoices delay payments and raise processing costs. Automating invoicing and collections speeds up payments and improves cash flow.

- Localization – A checkout process that is not localized to the target market increases shopping cart abandonment. TreviPay’s B2B Buyer Report finds that 72% of business buyers remain more loyal to a business that offers preferred payment methods.

- Automated trade credit – 85% of businesses want to pay with trade credit and are likely to buy more with financing.

Retail businesses often focus on providing a seamless experience for consumers but lack the tools to provide a similar purchasing journey to B2B buyers.

An example is the rise of Buy Now, Pay Later in consumer purchases. Buy now, pay later is the most popular eCommerce payment option for B2C in Germany, accounting for 30% of all payments.

Having the ability to provide automated invoicing and payment systems, along with strategically extending credit terms to international customers, is a powerful differentiator.

Be the business that delivers a frictionless experience – you’ll secure loyal customers and outpace your competitors.

Seamless Payments Drive Cross-Border eCommerce

Loyalty pays off with results. International eCommerce helps you reach new customers, boost brand recognition and diversify revenue streams.

A successful global expansion strategy prioritizes a streamlined, localized payment experience, no matter where customers are and what channel they engage with. Provide buyers with the convenience and flexibility they’re used to on consumer purchases and let TreviPay handle the rest.

TreviPay’s automated invoicing, trade credit and payment solutions increase customer loyalty and spending.

With more than 40 years of experience in B2B payments, we’ve helped countless businesses simplify and streamline international expansion efforts.

Don’t let the complexities of cross-border eCommerce payments hold you back from achieving your global ambitions.

Explore these 7 Important B2B Payment Considerations and prepare your business for successful global expansion today.