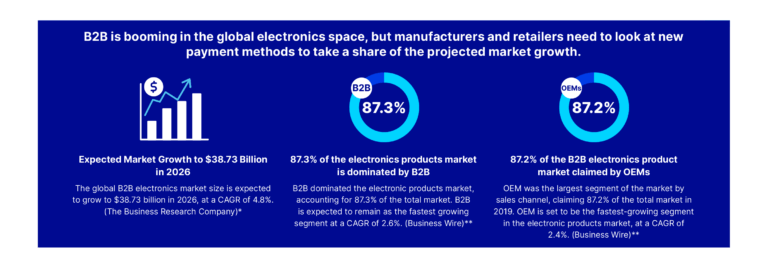

The electronics manufacturing industry has experienced significant growth in recent years, driven by increased demand for consumer electronics, such as smartphones and laptops, and technological advancements. This growth has increased B2B (business-to-business) transactions, as manufacturers and suppliers work together to produce and distribute these products.

B2B payments play a crucial role in the electronics manufacturing industry allowing manufacturers and suppliers to efficiently and securely transfer funds for goods and services. As the industry has grown e-invoicing and purchase order financing have become more widespread, allowing faster and more accurate payments.

However, the industry still has challenges in B2B payments, such as the lack of standardization and integration of payment systems, and the need for more robust fraud prevention measures to protect against cyber threats.

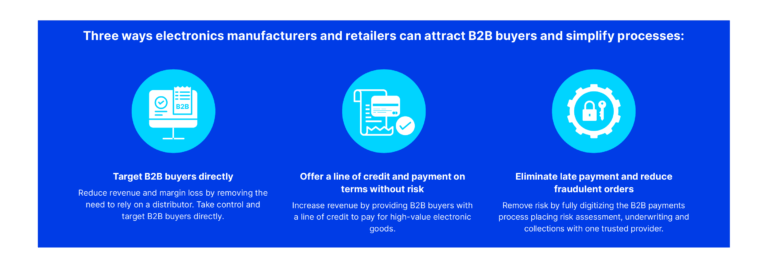

Going directly to B2B buyers and offering a line of credit and payment on terms can be a way for the electronics industry to grow.

By going directly to B2B buyers, manufacturers and suppliers can bypass intermediaries such as distributors and retailers and sell their products directly to end-users. This can help them increase their profits by cutting out the middlemen and potentially offering lower prices to buyers.

Offering a line of credit and payment on terms can benefit the industry, as it allows B2B buyers to purchase goods and services without having to pay upfront. This can help manufacturers and suppliers increase their sales and improve cash flow. Additionally, it also allows buyers to maintain their own cash flow and capital to invest in other areas of their business, which in turn can create a win-win situation for both parties.

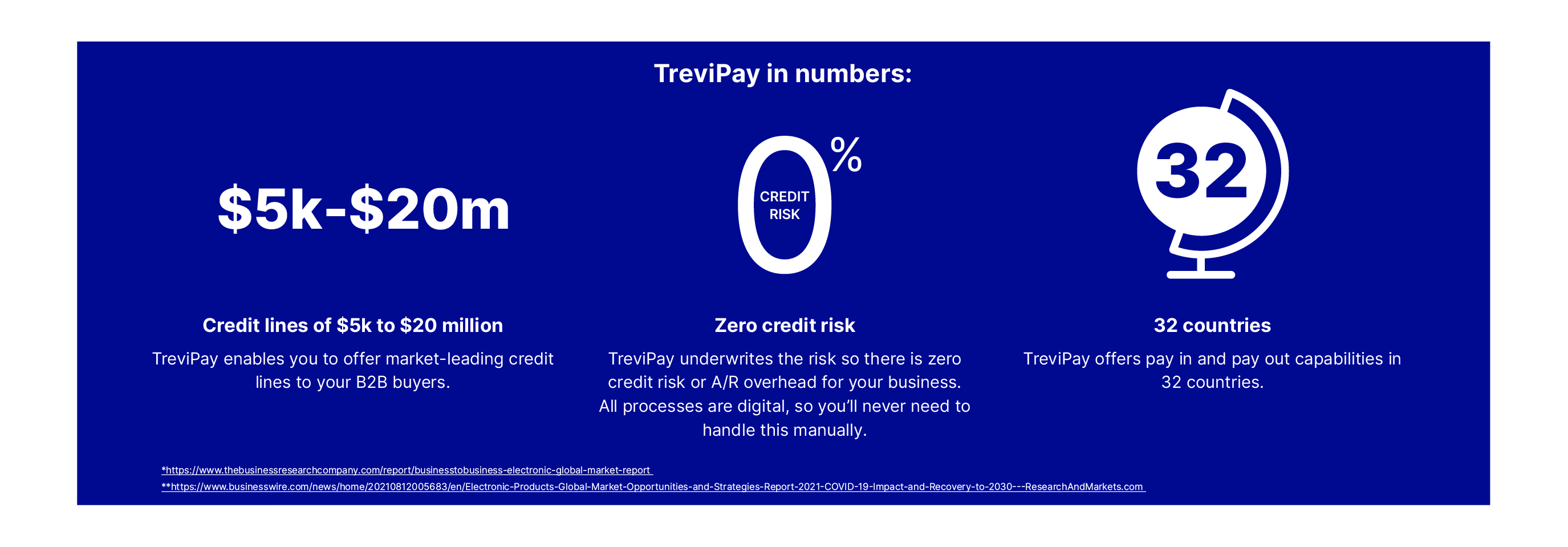

However, offering credit and payment on terms also comes with risks, such as credit risk, payment defaults, and fraud. Manufacturers and suppliers must evaluate each buyer’s creditworthiness and have proper risk management systems, but TreviPay offers underwriting services that eliminate risk for sellers and ensure they get paid on time.

TreviPay gives you the tools to power up your business with less risk. Schedule time with a payments expert today.