Receiving customer orders, fulfilling them and getting paid are the basis for most business operations.

Your cashflow, internal resources and customer services rely on the processes involved in being efficient and reliable.

This is why it is essential to understand and optimize the order-to-cash (O2C) process.

What is order-to-cash (O2C)?

Order-to-cash (often referred to as O2C or OTC) is a business term used to describe the process(/s) around fulfilling customer orders.

It essentially starts when your customers place an order and finishes when you have recorded the completed and paid-for orders in accounts.

In between, several steps take place (see below, ‘Steps of the order-to-cash cycle’). Afterward, data analysis and implementation of best practices can help you with the ongoing optimization of your order-to-cash process.

The order-to-cash process also sits between and overlaps with several other processes. For example, the marketing to lead (M2L), procure-to-pay (P2P) processes and other top-of-the-sales funnel activities.

Like O2C, these terms are used by your teams internally for reporting and strategizing purposes.

Why is it called the ‘order-to-cash’ process?

The phrase order-to-cash is used because it concisely summarizes the process from your customer’s order to your business receiving cash.

What’s the difference between the order-to-cash, quote-to-cash (QTC) and lead-to-cash process?

The main difference between the order-to-cash, quote-to-cash (QTC) and lead-to-cash processes is that the second involves generating quotes to customers before order entry and the third involves sales and marketing up to the point of a quote or order.

The quote-to-cash (QTC) process allows customers to understand their purchase better before making it. It is also useful when a pre-determined price or order volume is unavailable for a particular product or service.

Lead to cash is used to describe a more complete process than both QTC and O2C. It is useful for analyzing the link between early sales and marketing processes and the O2C or QTC process.

The differences between each respective process lie mainly in the precise span of processes they focus on. Each may involve a different department, software, steps for optimization, etc.

Why the order-to-cash process matters

The order-to-cash process is important for two main areas of your business:

- Internal: It is linked to the efficiency of your cashflow, internal resources, supply chain management and analytics. Effective cash management is crucial for ensuring that the O2C process contributes to your business’s financial health and liquidity.

- External: The more frictionless it is, the better your customer experience. This helps with your customer relations and retention in the short and long-term.

Many business processes are interlinked. The O2C process is no exception.

Errors at any of the stages involved (see below, ‘Steps of the order to cash cycle’) can have a knock-on effect on your business’ other functions.

For example, late payments or slow invoice processing can reduce your working capital. This, in turn, might prevent purchasing crucial materials or equipment.

As with many business processes, automation can speed up and reduce the number of errors in the order-to-cash process. However, for a truly optimal process, human oversight and involvement are also essential.

What are the reasons you might want to improve your O2C process?

You might want to improve your order-to-cash process because it has an acute (i.e., immediate) or chronic (i.e., persistent and long-term) negative impact on your business.

The reasons for both categories of problems might vary or even overlap.

For example, you might have a sudden lack of cashflow. This could immediately bring negative consequences, such as the inability to pay staff or cover other essential costs.

Or it might have a more subtle negative effect over time by adding uncertainty to your business forecasts, reducing the likelihood you target or take on certain projects, etc.

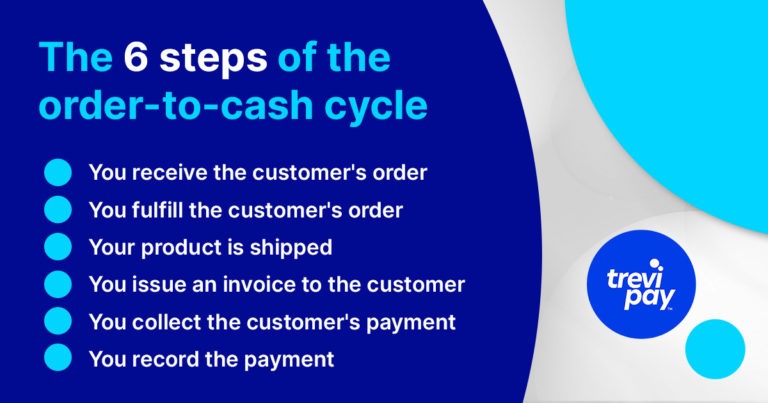

The 6 steps of the order-to-cash cycle

Before the O2C process has even begun, several important points exist. These include inventory management, POS system integration, customer onboarding and more.

Once these are in place, the following steps occur.

1. You receive the customer’s order

When your customer makes an order, the O2C process officially begins.

The order might be made online via a form or email, over the phone, or even in person.

To make this step as efficient as possible, monitoring order channels and promptly replying to – or even automating –confirmations of orders is essential.

Attention to detail contributes to customer satisfaction at this stage. For example, an initial confirmation mustn’t be sent if the inventory isn’t in stock, only to be followed up with a cancellation of the order.

An order management system helps optimize this and subsequent stages of the O2C process.

This stage might also involve invoice discounting or invoice factoring in many industries.

2. You fulfill the customer’s order

Fulfilling an order involves processing it (including checking order specifications, inventory checks and delegation) and organizing its delivery or shipping.

Further communication on estimated delivery times might be useful here, especially if a delay is likely.

Having real-time data tracking the fulfillment process helps ensure your entire team is on the same page. This reduces the chances of late, missed, or repeat orders.

3. Your product is shipped, or service is given to the customer

Shipping is the phrase used to describe products leaving your warehouse and traveling to your customer. It doesn’t have to involve actual ships, but it often does for international orders.

For services, this step involves giving a physical service or granting access to a software or platform. It is also important that services are delivered or made available quickly and easily.

4. You issue an invoice to the customer

Promptly issuing an invoice to your customers increases your chance of being paid on time.

You need to ensure that the details of your invoice are correct. This includes value, invoice number, order details, payment terms, etc.

Having your order management system integrated with an updated CRM will help make sure the invoice and subsequent reminders are sent to the right person.

5. You collect the customer’s payment

Collections of payments are a big part of credit management, which is an essential part of every business’s health.

Late payments are common across many industries. 1 in 6 small businesses reports being paid late, for example.

The chance of you being paid on time is improved by implementing best practices for collections. This can include optimizing or automating practices such as dunning or using specialist tools for accounts receivable management.

6. You record the payment

Once an order has been delivered and paid for, recording payments in the general ledger accurately helps you keep up with accounting and data management.

Errors in reporting at this stage can create problems for different parties in your business, such as the sales, accounts receivable and accounts departments.

Invoice management software can help you maintain a complete and up-to-date accounting record. It also helps you with data management.

The next generation of order-to-cash systems and technology

Data and technology are leading innovations in the O2C process.

Integration with third-party technology can help by outsourcing underwriting and finance offerings.

For example, utilizing invoice management software can improve your invoicing process. Integrating with your CRM, also helps keep all departments involved in the O2C process on the same page.

As we explained in our white paper ‘The Innovating Order to Cash Playbook: Putting Manufacturers and Distributers in Control of Their Cash Flows‘:

[O2C products] paired with CRM services can offer manufacturers the insights they need to identify additional growth opportunities and reach wider customer bases, which means the right integrations can help them truly focus on their expansion efforts.

Conclusion

The order-to-cash cycle involves several interconnected processes.

It begins with receiving customer orders and ends with payment collection. In between, your order management process should delegate and record several steps, including order fulfillment, shipping and invoice issuing.

The first step of an O2C process is receiving an order. Responding quickly and accurately to this request requires monitoring communication channels and inventory management.

This process can also include financing options, such as invoice financing or trade credit.

Next, fulfillment of the order needs to take place. This is made more effective by communication internally and with the customer.

Once you have shipped an order, provided a service, or access to a service, you need to issue an invoice.

Once a payment is collected, you need to record it in the general ledger.

Optimizing each part of the O2C process will help improve your cashflow, the performance of your resources and customer satisfaction.