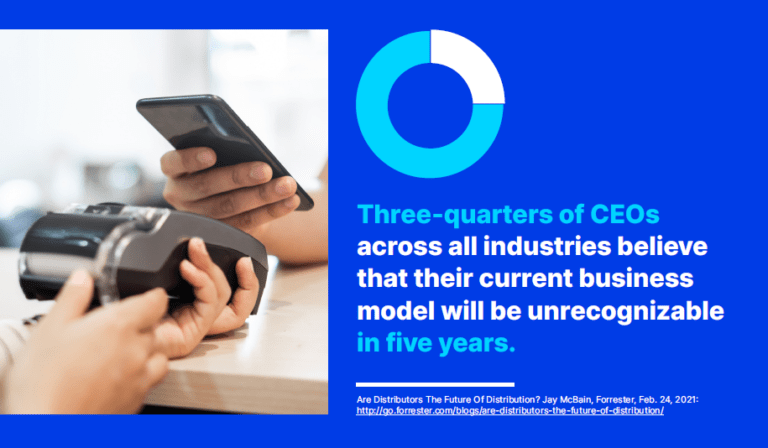

If your customers are like 9 out of 10, they’re researching payment methods before establishing a relationship with a new vendor. Buyers are constantly searching for more seamless payment methods to help streamline purchasing, which is why it is so important to continue growing your payment options as your business evolves.

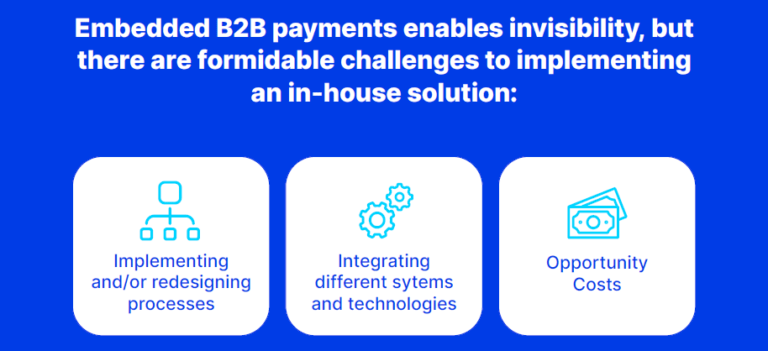

When it comes to an embedded payment solution growing your payment options in-house can be quite the undertaking between the cost of your team’s time to build new systems and create the integrations for an embedded payment solution. To keep your business on track, it is more efficient to partner with a network such as TreviPay.

With TreviPay’s payment solution you will be able to process instantaneous B2B embedded payments, white labeled as your own system. Additionally, with our solution, your B2B business will be able to offer trade credit through a seamless digital process that helps to filter out fraud while maintaining an excellent customer experience.

Ready to learn more about Embedded Payments?

Download TreviPay’s groundbreaking eBook Embedded Payments: How to Build Faster, Smarter B2B Payments Systems to begin to build your embedded payments program.