Whether shopping or just surfing, everyone is in a hurry online.

An ‘online second‘ is even shorter than a ‘New York minute‘.

For example, one study found that websites with 1-second loading times have 3x higher conversion rates than those with 5-second ones (and 10x higher than those with 10-second ones).

Payments are a significant part of this picture. Seconds and even fractions of a second matter when it comes to payment acceptance.

This is why embedded payments are essential if you want your business to thrive online.

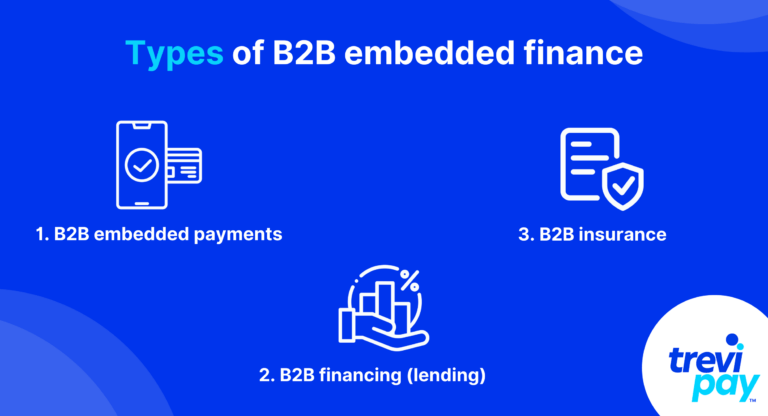

What Is Embedded Finance?

Embedded finance refers to the integration (embedding) of various financial products and services into non-financial service companies’ processes via APIs (application programming interfaces).

These financial services include banking services (like access to current accounts), lending, insurance, investing, and more.

They conveniently enable businesses to provide customers with different ways to fund their purchases, such as Buy Now and Pay Later options, and they provide them at the crucial time – at checkout – which can significantly reduce cart abandonment for businesses.

Third-party alternative lenders often work with traditional financial institutions to provide these services. And payment orchestration platforms that specialize in the end-to-end integration and management of payment systems can help achieve this.

Types of B2B embedded finance

What are Embedded Payments?

Embedded payments are online-based payment methods that – most of the time* – don’t require more than one-step verification by the buyer, making them ideal B2B payment methods for enhancing transaction speed and efficiency. They should be efficient and unobtrusive.

The most common example is one-click payment capability on eCommerce stores, i.e., ‘Buy Now’ buttons that complete a payment.

They are technically a type of embedded finance – and the most popular type, too. However, they are often discussed separately from other forms of embedded finance options and solutions.

This is because they are relatively straightforward and widely recognized. They are suitable for just about every business. Other financial services are more industry and company-specific.

Contactless vs Embedded Payments

The difference between embedded and contactless payments is that the former refers to a physical, in-store process, whereas the latter refers to an online experience.

Embedded payments can be viewed as the online equivalent of contactless payments in terms of speed and customer convenience.

What Are Frictionless Payments?

“Frictionless payments” refers to contactless or embedded payments that provide a simple and easy-to-complete payment experience.

All embedded payments should aim to be frictionless. However, not all will achieve this.

For example, if changing shipping addresses at the online checkout isn’t easy, then payment services are embedded – but they are not frictionless for all users.

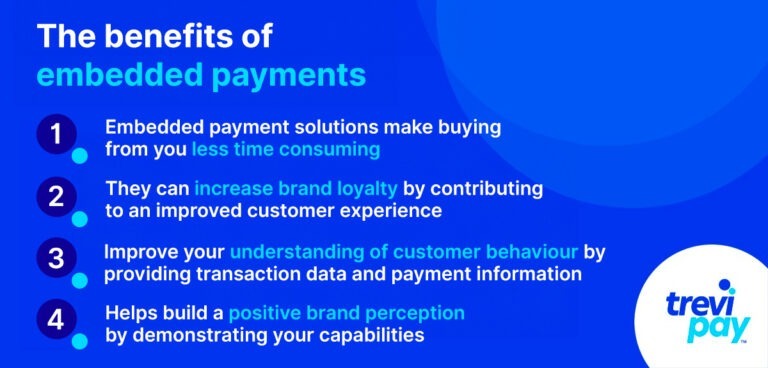

Benefits of Embedded Payments

There are many benefits of embedded payments. In addition to improved customer experience, there are clear and tangible benefits of embedded payments for merchants.

1. Increased Conversion Rates

Embedded payment solutions make buying from you less time consuming. This reduces the chances your customers will become frustrated, distracted or lose interest in a purchase.

Unlike in-store shopping, online shoppers are only ever seconds away from your competitors. Like good user experience more broadly, embedded payments reduce this risk of sudden defection.

2. Increased Customer Loyalty

Embedded payments can increase brand loyalty in a similar way to how they increase conversion rates – by contributing to improved customer experience.

Some clients have more than one preferred payment method. Providing all of these embedded payment solutions will significantly contribute towards retaining their custom.

3. Better Analytics

Embedded payments can provide transaction data and payment information that is useful for improving your understanding of customer behavior.

This in turn can help your marketing strategy. You can prioritize particular products, create personalized offers or marketing campaigns and carry out other activities that further increase sales.

4. Brand Perception & Trust

The presence of embedded payments can contribute towards building a positive perception of your brand. It sends a signal about your businesses’ capabilities and forward-thinking attitude .

It also reassures customers and potential customers. Many may trust and associate embedded financial services with payment security. All of these embedded payments considerations go towards promoting brand loyalty.

Choosing the Right Embedded Payments Provider

There are a range of potential third-party providers such as fintech companies for embedded payment solutions.

Finding the right one for your business can make a big difference in what kind of embedded payments you provide and how well they are implemented and maintained.

Embedded payments work not just as business tools but as a strategic asset, too. So, it’s important to consider the value-added services your payment provider brings.

This can include everything from helping you gain deeper insights on your industry and payment trends to simply being available for customer support when needed.

Security for embedded Payments

Financial institutions need to adhere to industry standards on transaction security and the management of sensitive data. The embedded payments industry and fintech companies are no exception to this.

Bad actors are consistently looking to figure out flaws in the movement of money through payment channels. You need to be mindful of issues around this, including how you contact your customers, validate their transactions, etc.

The importance of point of sale (POS) integration

Integrated POS solutions help keep your business in-sync and efficient. And website integration with your POS systemcan be a game-changing part of this.

But getting it right is not always a certainty…

Multiple different types of software might need to be integrated. Done well, it eliminates manual data entry, reduces human error and speeds up transaction processing.

It also allows for real-time financial data visibility, improved inventory management and reconciliation. This can help free up your employees’ time and energy, creation, digital wallets to hold funds, fund transfers and card issuing.

B2B Embedded Payments and Embedded finance

The business-to-business (B2B) field is different to the business-to-consumer (B2C) one in some important ways.

As a result, embedding most B2B payment methods and solutions for B2B finance is considerably more complex than for B2C equivalents, requiring robust credit management practices to ensure sustainability and minimize risk.

For B2B buyers, the process is likely to involve multiple stakeholders, including the purchaser, budget owner, procurement group and accounts payable team.

Complexity is further increased by procedural and technological integrations. These are needed for dealing with 30-, 60- or even 90- day net terms and accounts receivable processes.

Despite the added specialized processes and expertise required, B2B embedded payments offer substantial benefits. These are similar to B2C solutions, albeit often at a larger scale. These include:

- Increased buying ease and convenience

- Meeting stakeholders’ expectations

- Fostering stickier customer relationships

- Higher share of wallet

- Improved lifetime customer values

- Optimized cashflow management and reduced day sales outstanding (DSO)

TreviPay’s B2B Embedded Payments Solutions

Today, embedded payments is about more than just enabling purchases with a few clicks. The entire B2B buyers’ journey needs to be considered.

At TeviPay we offer specialist B2B payment solutions, including embedded payments. This enables you – whether you are an SMB or enterprise – to offer invoicing options at checkout with real-time authorization across all sales channels.

By using trade credit, your buyers are able to purchase more without using their own valuable cashflow.

Our solution ensures brand consistency throughout the user journey and facilitates omnichannel purchases via eCommerce, marketplace, offline and in-store options.

Read our whitepaper on embedded payments here.