Three of the world’s five oldest companies are hotels.

The oldest is over 1,300 years old: the Nishiyama Onsen Keiunkan hotel in Japan, founded in 705 AD.

It has thirty-seven rooms, natural hot springs, and has been run by the same family for fifty-two generations.

So, hotels have been around for a long time. But nowadays, innovation is essential if they want to thrive in a competitive industry. Given the explosive digitization of almost everything B2B, now is the time to automate and streamline B2B sales with direct billing, hotel contract networks with companies and fully automated A/R processes.

One way – other than natural hot springs – in which hotels can do this is by introducing direct hotel billing.

What is direct hotel billing?

Direct hotel billing is a payment method where the bank accounts of the companies that hotel guests represent are charged directly for the hotels’ services.

This occurs instead of the guests personally paying when either booking or checking in or out of hotels.

It creates convenience and efficiency for all parties involved.

For guests, it saves time in filling out forms, making payments directly, and risking obstacles/inconveniences to their travel plans.

Like direct billing more broadly, it saves companies the paperwork and time needed for approvals and reimbursements.

And it speeds up the time that it takes for hotels to receive payments, which improves their cashflow.

Consider the time saved if staff didn’t have to chase late payments. The ideal direct billing provider takes on the burden of collections while ensuring that hotels receive payments in two, seven, 14, or 30 days—whichever is preferred. With collections and cash flow headaches eliminated, the A/R team can spend more time servicing hotel contracts and business networks.

Innovation for B2B guests

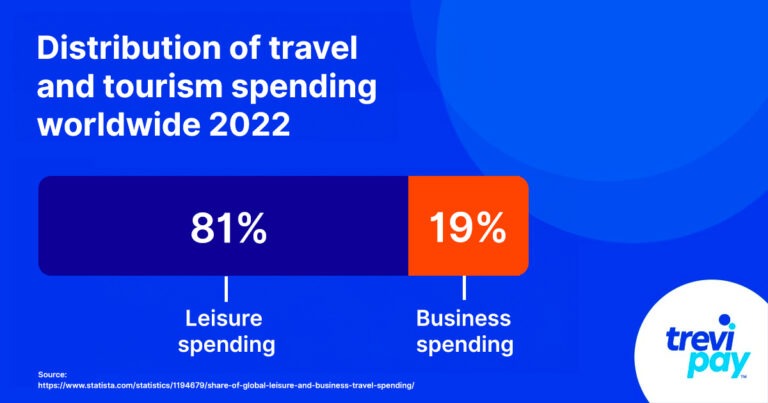

Business travel accounts for 1/5 of the global tourism industry. Estimates vary, but they generally state that business travel makes up between 40% – 52% of hotels’ revenue.

So, attracting and retaining corporate customers is a must for your hotel. To do this, you should attract procurement and accounts departments by making a seamless billing and invoicing process a reality.

From the business traveler’s perspective, the loyalty-building benefits are clear. They don’t have to use a personal credit card; make sure they have a corporate credit card; worry about spending limits; keep hotel-related receipts; or file expense reports. Of course, they’ll want to stay with that hotel again.

Direct billing for competitive advantage and increased RevPAR

Direct billing enables your hotel to issue invoices. This means your corporate customers can pay for accommodation just as they would for any other business expense – by invoice on terms.

This makes securing blocks of rooms more attractive and contributes to a higher RevPar (revenue per available room).

In fact, RevPAR is one of the most significant factors for building hotel revenue. There are two ways to calculate it:

- RevPar = Rooms Revenue / Rooms Available

- RevPar = Average Daily Room Rate x Occupancy Rate.

Hotel operators usually calculate hotel RevPar daily, monthly or annually, and it serves as a key metric for tracking business performance. But in addition to being a key performance indicator, RevPar also helps hotels operate more efficiently through better room rate planning and strategizing.

Direct billing technology plays a critical role in increasing hotel RevPar by enabling hotels to issue invoices, allowing corporate guests to pay for their hotel stays just as easily as they would for any other business expense — by invoicing on terms.

A use case for direct billing for hotels

If you employ contractors, direct billing can be very useful.

In this example, let’s use a construction company that needs to send people to job sites that require overnight stays. (Though these issues apply to companies across most industries).

The construction company may ask contractors to put hotel charges on a personal card. This will cause problems if the contractor does not have a credit card or insufficient credit available.

Employees and contractors will need to submit their card receipts for their stay. The company dedicates resources within its finance team to validate and manually reconcile the paperwork.

How direct billing works in the hotel sector

To attract corporate clients, such as the construction company, a hotel chain selects an outsourced supplier to implement a direct billing solution.

This enables the hotel chain to offer its corporate clients a pay on terms solution that comes with a line of credit.

The corporate clients’ eligibility for credit is instantly assessed by the supplier who underwrites the line of credit for successful applicants.

This reduces the risk for the hotel chain, and from that point onwards, the invoices issued are paid by the supplier rather than guests.

Competitive advantage through payment choice

By implementing a direct billing solution, the hotel chain creates benefits for itself, the construction company, and its workers.

Direct billing creates a competitive advantage for hotel chains. And offering payment on terms makes it easier for your hotel, or hotel chain, to do business.

The digital checkout removes the friction for both the corporate traveler and the A/R department by integrating the digital billing and payments process.

That is likely to lead to higher levels of repeat business, long-term loyalty and profitability. Because the hotel is paid by the supplier rather than its clients, once the line of credit is in place, the need for resources to chase unpaid invoices goes away.

Ultimately, the hotel can grow its business by serving its corporate clients via digital transformation and integrating digital billing and payments.

For corporate clients, such as the construction company, the benefits are based on efficiency and reduced costs.

They can negotiate discounts based on volumes with the hotel chain, which benefits both parties. The client’s need to issue corporate travel cards to employees is eliminated along with the complexities of contractors accessing hotels.

All expenses for all travelers are consolidated within a single invoice, drastically reducing the internal resources required to manage finance processes.

The client can access folios in real-time. This enables them to monitor where their travellers are staying as well as individual spending data.

When the client’s workers are ready to check out, there is no need for a card. They are free from the administrative burden of tracking, reconciliation and reporting their business expenses. And they are free from the inconvenience of waiting to make a payment.

Who offers direct billing?

There has traditionally been a wide gap between the consumer experience of payments and that afforded to B2B buyers.

The huge success of direct billing programs globally has exposed an opportunity for B2B providers to differentiate themselves with more efficient direct billing options.

Being able to assure smooth B2B payments improves the B2B buying journey considerably.

Corporate customers prefer to purchase on terms and spend more, more frequently when they have a dedicated financial relationship and credit line with a business.

Direct billing solution providers like TreviPay learn how to ignite your digital transformation efforts through risk-free automation. This gives hotels the ability to focus on maximizing AOR and RevPAR.

Conclusion

As old as the hotel industry is, it still needs innovation to move with the times.

Direct hotel billing streamlines financial transactions for guests, particularly for B2B travelers, who represent a substantial portion of hotels’ revenue.

Direct billing eases payment procedures for guests, reduces paperwork for corporations, and speeds up payment receipt for hotels.

This payment method, typically enabled through an outsourced supplier, gives hotels a competitive edge and contributes to increased RevPAR.

For corporate clients, this means better efficiency, cost reductions, and the elimination of complexities related to accommodation. All of this leads back to providing your corporate clients and their travelers with a highly satisfying, seamless experience — all the way through to billing.

Programs such as those offered by TreviPay are bridging the gap in the B2B buying journey, offering risk-free automation for hotels and fostering more efficient direct billing options.

As this trend picks up, the hotel industry is sure to benefit from improved client relationships, increased repeat business, and higher profitability.

How a National Hotel Network Made Corporate Travel More Flexible with TreviPay