Businesses’ cashflow usually has peaks and troughs throughout the year. The peaks are usually good news, but the troughs can create problems.

Invoice factoring can help you regain some control over this. Especially if you use it at the right time and in the right way.

It is a useful service for both your business directly and to provide to your customers.

But what is invoice factoring? And which type is right for your business?

Invoice factoring definition

Invoice factoring is a financial transaction in which you sell your accounts receivable invoices to a third party (known as a factoring company or factor).

It is one of the two main types of invoice financing available. The other type is invoice discounting.

Read on to find out how exactly it works (‘How the invoice factoring process works: 4 Steps’).

What’s the difference between invoice factoring and invoice discounting?

Invoice factoring is a slightly more complex but more comprehensive transaction than invoice discounting.

This is because it involves the factoring company carrying out collections of invoices on your behalf, whereas invoice discounting doesn’t.

What’s the difference between invoice factoring and receivables financing?

Accounts receivables (A/R) financing is when a company gets a loan based on its existing accounts receivable (i.e., its invoices).

A/R financing and invoice factoring are different in several ways. For example, A/R financing is a loan usually provided by banks, whereas factoring is a sale of invoices provided by specialist factoring companies.

Why use invoice factoring?

Invoice factoring is a relatively expensive form of financing. But it is also one of the fastest and most straightforward to deploy.

When it works well, your buyers pay invoices according to their preferred terms and you get paid (most of the invoice) much quicker.

How the invoice factoring process works: 4 steps

Different invoice factoring companies’ processes might vary in some details, but most conform to the steps below.

These steps need to include the onboarding process, which is relatively fast. For a deeper understanding of how invoices are managed before factoring, you can learn more about the invoice processing steps involved. Most invoice factoring companies don’t require the level of checks needed for a business bank loan.

Step 1: You provide goods and/or services as usual

Your business sells its goods or services as usual. Clients need to learn that you intend to use a factoring service at this point.

Step 2: You sell your invoices to the factoring company

An invoice factoring company (often referred to as a factor) purchases your outstanding invoices at a discounted rate. It then provides you with an immediate cash advance of up to 90% of the invoices’ total value.

The exact type of factoring recourse (see below, ‘Types of invoice factoring’) and cost (see below, ‘How much does invoice factoring cost?’) will depend on several variables. These include the volume of invoices, your customers’ credit ratings, etc.

Step 3: The factor collects the invoice

Factoring companies directly collect invoices from your customers on your behalf. This may require them to contact your customers.

They only collect invoices according to the payments terms listed on the invoices. The average terms vary for different industries.

For example, in the food and beverage sector, payment terms are often very short. By contrast, in the freight broker industry, they are relatively long.

Step 4: The factor pays you the remaining balance

Once your customer pays their invoice directly to the factor, it sends the remaining value to you (minus their fees).

How much does invoice factoring cost?

There are several variables that your factor will consider before calculating costs for invoice factoring.

Your industry, clients and factoring provider are all an important part of this. So too are the value and volume of invoices you have factored. And precisely which kind of factoring you use (see below, ‘Types of invoice factoring’).

And of course, there are sign-up fees, late payment fees, and contract termination fees. There may also be other hidden fees in some cases (always read the small print…).

Aside from these variables, the factoring fee is made up of the following.

1. Discount fee

The discount fee (also known as the discount rate or factor rate) is what the factoring company charges for factoring an invoice on your behalf.

It is given as a percentage of the invoice’s total value, which it usually ranges from between 1.5 – 5%.

It only applies to the initial funds advanced and is calculated as an annual rate that is charged weekly or monthly.

2. Service fee

The service fee is an administration fee charge. It covers the costs of a range of services related to processing and managing invoices, including tasks such as collections, etc.

It is usually between 0.5 – 2.5% of the value of invoices factored.

Types of invoice factoring

Invoice factoring services vary between suppliers. Below is a list of some of the main types of services available.

1. Selective factoring

Selective factoring (sometimes called spot factoring) is when you have a small number of your invoices factored.

Generally speaking, invoice factoring companies service your entire sales ledger. So selective factoring enables you to laser in on specific clients/accounts.

This may be useful when you want to tactically increase your cash flow.

For example, you may need to access invoice value from a particularly large account but want to avoid the costs of factoring for the rest of your sales ledger.

2. Recourse Factoring

Recourse factoring is when you guarantee to buy back any of the accounts receivable you sold to the factoring company that go unpaid or are disputed by your customer.

Because you remain liable for unpaid invoices in this arrangement, the factoring company might offer higher cash advance rates and lower factoring fees.

The factoring company may also take a more rigorous look at your creditworthiness than they would with other types of factoring.

3. Non-Recourse Factoring

Non-recourse factoring is when the factoring company takes on the credit risk and liability for unpaid invoices. It is less commonly used than recourse factoring.

For taking on that risk, the factoring company will charge you a higher fee, offer lower cash advances, and be more selective in choosing which invoices it buys.

4. Notification factoring

Notification factoring is when your buyers know that a third party is processing your invoices on your behalf.

5. Non-notification factoring

Non-notification factoring is when your customers are unaware that they are paying their invoices to a third-party factoring company.

Advantages and disadvantages of invoice factoring

We have previously spoken in more depth about the advantages and disadvantages of using invoice factoring for your business.

Here is a brief summary.

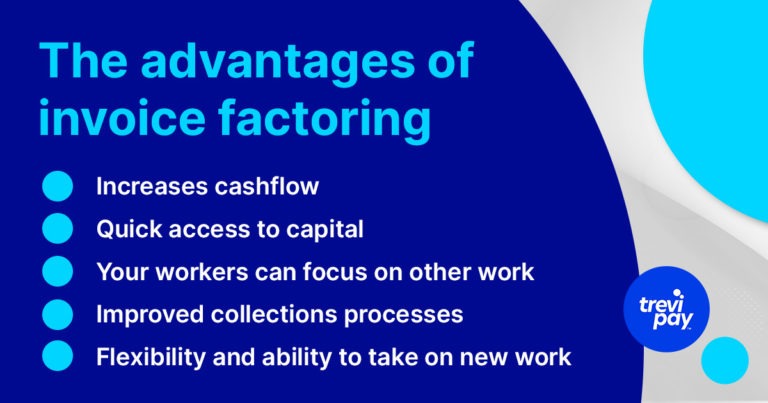

Advantages of invoice factoring

1. Increases Cashflow

The main benefit of invoice factoring is the access it provides to cash flow. This might benefit your company in several ways, from helping you stay afloat to aiding your growth.

2. Quick access to capital

Unlike a bank loan, invoice factoring has a relatively short approval timeframe. Less extensive background and credit history checks are required.

3. Your workers can focus on other work

Because it outsources collections, it also frees up your internal resources. In fact, this might even save you money if the cost is less than paying an internal collections team.

4. Improved collections processes

Most factoring providers will have an efficient and effective collections process. This could result in an improved collections process for your business.

Furthermore, some find that customers pay a third-party company quicker because – unlike when paying you – they are worried about the impact on their credit rating.

5. Flexibility and ability to take on new work

Finally, the knock-on effect of all of the above is that it puts you in a position to quickly improve cashflow and utilise your internal resources when needed.

This means your business will be more agile and prepared to seize new opportunities.

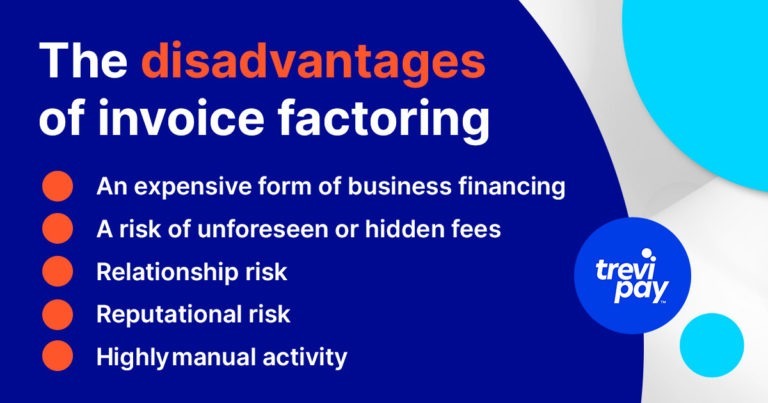

Disadvantages of invoice factoring

1. A relatively expensive form of business financing

The main drawback of invoice factoring is its cost. It is a relatively expensive form of financing. In the long run, the fees you pay for it will add up.

2. A risk of unforeseen or hidden fees

Like other financing methods, there is always a risk that you might not be able to cover your costs. This could be the case if you suddenly lose customers, for example.

If you sign up with the wrong factoring company, you may be charged hidden costs, unable to easily break your contract with them, etc. This is particularly difficult if you are using a non-recourse factoring service.

3. Relationship risk

Notification factoring, which is more common than the non-notification version, also adds risk to your customer relationships. Factors’ collections processes and manner might disturb some of your customers.

4. Reputational risk

Buyers need to be informed that the process has changed. Sometimes the use of a factoring company can raise questions among your buyers about your financial stability.

When payment submission errors arise, your customers are involved in correcting those errors, which adds friction to the payments process and can tarnish the customer experience.

5. Highly manual activity

Several decisions need to be made based on interrelated variables. For example, a non-recourse factoring arrangement may result in you paying higher fees.

Also, factoring companies typically need to manually verify an invoice after it has been submitted.

That process is rarely, if ever, entirely digital. A human often has to reach out to the buyer to verify the expense. And routing the payment to the supplier may or may not be a digital process.

Alternatives to invoice factoring

Factoring is often a short-term and expensive solution to a common problem.

But looking more broadly, there are alternatives solutions that optimise your working capital while also offering additional benefits that help encourage higher customer spending and loyalty.

Invoice discounting is one alternative, so too are merchant cash advances, venture debt, lines of credit and business loans.

Offering your clients invoice factoring

Just as you can benefit from using invoice factoring services, you can also benefit from offering it to your customers.

When your customers are able to better access funds, they too can spend and grow more.

Setting up your own invoice factoring service from scratch isn’t practical. But outsourcing to a trusted third-party provider is.

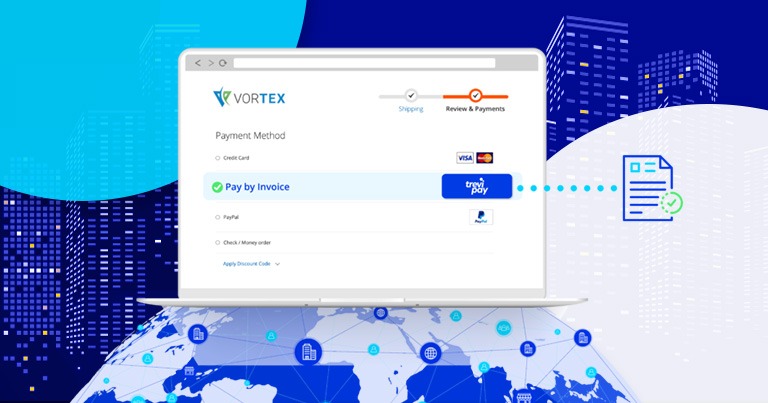

Embedded payments & TreviPay’s solution

The concept of embedded payments in B2B transactions has become a hot topic in recent years.

The TreviPay solution includes a cost-effective alternative to factoring with the ability to offer a line of credit to your B2B buyers. As this credit is underwritten by TreviPay, the liability for the credit and the responsibility for unpaid invoices are no longer yours.

Assessing creditworthiness, customer onboarding, managing the customer experience, and process efficiency are all critical to business performance and customer relationships.

TreviPay enables you to optimize and embed these into your processes to make your commercial terms more flexible and your business a preferred supplier.

Summary

Invoice factoring is a type of invoice financing. It involves selling unpaid invoices.

The invoice factoring process differs slightly from invoice discounting, but it is still relatively straightforward.

You get paid up to 90% of your invoice value upfront, then when your client pays the following 10%, the factoring company pays you the remaining invoice value (minus their fee).

It is more expensive than invoice discounting and other forms of business loans. However, it enables you to access capital faster. This is useful if you have poor cash flow or simply want to accelerate your growth.

There is more than one kind of factoring facility to choose from, including: selective, recourse, non-recourse, notification, and non-notification factoring.

The exact cost of this service depends on several variables including your industry, customers, volume of invoice, and more. However, the main fees involved are the service and discount fee.

Using a third-party provider, you can offer to factor invoices for your customers. This can increase their spend and loyalty.

For most invoice factoring work, the factoring company collects your outstanding invoices for you. This brings with it both potential risk and rewards.